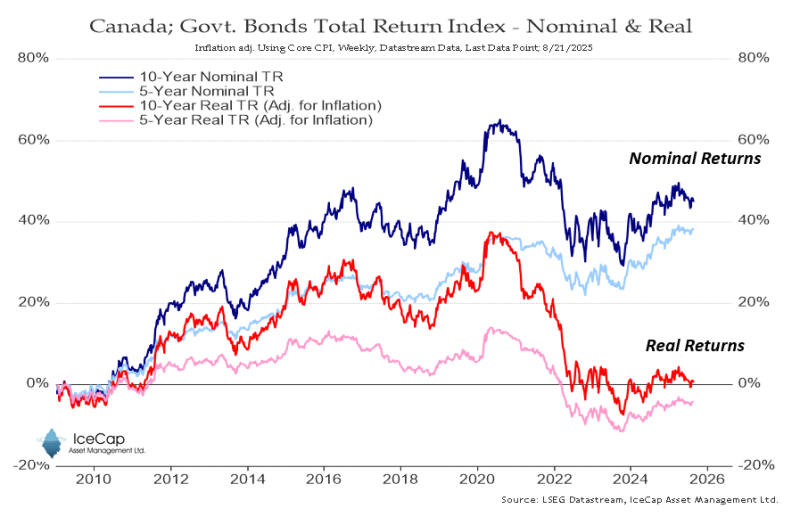

For decades, government bonds were the go-to safe haven—a reliable way to preserve wealth over the long haul. But new data from Canada tells a troubling story: while bond prices look healthy on paper, inflation has quietly eaten away at real returns, leaving investors with virtually no purchasing power gains over the past 15 years.

Trader Highlights the Bond Market Reality

Market analyst @RichardDias_CFA recently broke down what's really happening in Canada's bond market, and the numbers are eye-opening. Sure, 10-year nominal total returns have climbed over 40% since 2010, and 5-year nominal returns sit around a respectable 30%.

But here's the kicker: when you factor in core inflation, those impressive gains vanish. The real returns—shown in red and pink on the chart—have flatlined at zero or worse. Investors who thought they were steadily building wealth have actually watched their buying power go nowhere.

Inflation, Fiscal Indiscipline, and Central Bank Risks

The underlying problem is becoming harder to ignore. Canada keeps running hefty budget deficits while the central bank faces mounting pressure to cut rates, even as core inflation refuses to budge. As one analyst bluntly put it: "with no fiscal discipline to speak of and a central bank likely to provide air cover by cutting rates in the face of rising core inflation, Canadian government bonds may produce some unpleasant experiences for investors."

This policy cocktail is risky business. Rate cuts might lower borrowing costs temporarily, but they also risk stoking more inflation—which would further demolish real bond returns.

Investor Implications: Bonds No Longer a Safe Haven?

The wake-up call is loud and clear for pension funds, insurance companies, and individual investors who've counted on government bonds as their safe, steady anchor. Positive returns on your statement don't mean much if inflation is eating away at what those dollars can actually buy.

If Canada's deficit spending continues and inflation stays elevated, investors will likely demand higher yields to hold Canadian debt. That creates a nasty feedback loop: higher borrowing costs for the government and continued headaches for bondholders who just want their money to keep pace with rising prices.

Usman Salis

Usman Salis

Usman Salis

Usman Salis