- 2WinPower - Full-Cycle Turnkey Leader with Controlled Customisation

- 2) EveryMatrix - Modularity at High Volume

- 3) SOFTSWISS - 30K+ Game Aggregator with Fast Integrations

- BetConstruct - Omnichannel with Wide Integration Bus

- 5) Slotegrator - Speed Through APIgrator

- 6) Digitain - Sports Platform with Social & AI Features

- 7) NuxGame - Fast Start and Mid-Scale Growth

- 8) Pragmatic Solutions - Pure API-First PAM for Deep Customisation

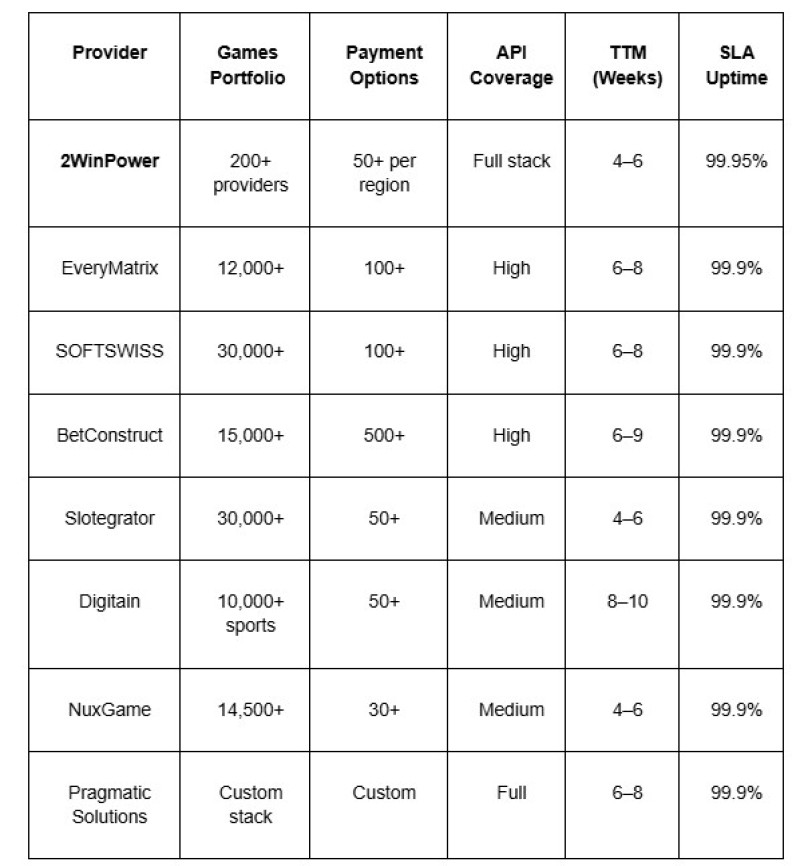

- Key Comparative Metrics for 2025

- FAQ: Flexibility & Scalability in iGaming Platforms

- Final Takeaways

These two factors have become the main competitive advantage in 2025 for iGaming platforms, where time-to-market and the cost of scaling often decide whether a project will survive the next 12–24 months.

Our ranking is based on:

- Public product and financial updates from 2024–2025.

- Quantitative metrics: content portfolio, number of brands/providers, integration speed.

- Signs of a mature ecosystem: API coverage, release frequency, M&A migrations, and client geography.

- Verified performance data and real-world deployment cases.

2WinPower - Full-Cycle Turnkey Leader with Controlled Customisation

2WinPower leads our list as a strategic partner for operators who want turnkey speed with deep customisation. Their ecosystem covers licensing, payments, AI-driven marketing, CRM, and bonus engines, all within one managed environment. The company has delivered 10,000+ projects in 20+ years, proving both market resilience and execution consistency.

- Portfolio includes Turnkey + White Label solutions with access to 200+ content providers.

- Documented TTM (time-to-market) as low as 4–6 weeks for new jurisdictions.

- Proprietary CRM and bonus modules with multi-brand management.

- Proven migration cases with zero bonus or wallet loss during transitions.

Modular integration map (games, payments, KYC/AML, anti-fraud) and API-ready connections allow adding or replacing services without altering the platform core. Operators can roll out localised game mixes or payment stacks instantly.

Infrastructure supports multi-jurisdiction operations with localised compliance packs. The platform is optimised for traffic spikes during major sports or promo events, with SLA-backed uptime.

For operators with growth plans (2× or 3× scale in 12–24 months), request:

- SLA & MTTR targets.

- Integration roadmap.

- Load test profiles for your target markets.

2) EveryMatrix - Modularity at High Volume

One of the most convincing scaling cases thanks to the CasinoEngine / GamMatrix / OddsMatrix suite. The modular approach allows building a “Lego” stack for casino-first, sportsbook-first, or hybrid strategies.

- Q1 2025: €54M net revenue (+39% YoY), EBITDA €28M (+27% YoY) - growth from existing clients, proving scalability without rebuilding the core.

- CasinoEngine handles 6B+ game rounds/month and €6B+ monthly turnover.

Modular build from PAM to marketing; isolated components; migrations after M&A without shutting down the monolith.

3) SOFTSWISS - 30K+ Game Aggregator with Fast Integrations

Dominates in content scale and compliance maturity, offering a one-API connection to a massive portfolio.

- 27,800+ games from 280+ providers (Feb 2025).

- 1,311 brands in Q1 2025 (+25% YoY).

- July 2025 milestone: 30,000+ games.

One API + 300+ providers = instant assortment expansion without core changes.

BetConstruct - Omnichannel with Wide Integration Bus

Strong in retail ↔ online convergence and ecosystem breadth.

- 15,000+ games from 250+ suppliers in Casino Suite.

- 500+ payment gateways.

- Affiliate network: 4,500+ affiliates, 630+ operator partners, reaching 30M+ players.

Extensive payment & content integrations, omnichannel capabilities, and rapid localised storefront builds.

5) Slotegrator - Speed Through APIgrator

Focused on fast time-to-market via a single contract APIgrator, connecting both content and payments.

- 30,000+ certified games from 180+ developers.

- Ready-made retention “recipes” for 2025.

One-window integration dramatically shortens launch timelines.

6) Digitain - Sports Platform with Social & AI Features

If sports betting is the core, Digitain offers scalable event coverage enhanced with social engagement features.

- AI-powered recommendations, SportChat, jackpots, and custom front-end.

- Multiple 2025 awards for sports UX.

Rich sports feature set + API allows rapid local market adaptation.

7) NuxGame - Fast Start and Mid-Scale Growth

Balanced entry cost and growth capacity for new operators.

- 14,500+ games from 120+ providers.

- Shortlisted “Best Aggregator 2025” (SiGMA Europe).

Fast API integration and predictable economics make scaling across multiple markets easier.

8) Pragmatic Solutions - Pure API-First PAM for Deep Customisation

API-based platform (PAM + CMS + data) for integrating “best-in-class” third-party services.

- API-first strategy confirmed in 2025 integrations (e.g., Thrilltech jackpots).

Full composability of the stack; rapid component replacement without forking the core.

Key Comparative Metrics for 2025

FAQ: Flexibility & Scalability in iGaming Platforms

Why is API-first so important for scaling?Because it allows you to swap or add services (games, payments, bonus engines) without downtime or core code changes.

How many games should a scalable casino start with?At least 10–15K titles at launch, with guaranteed monthly content updates to keep retention high.

What’s the ideal SLA for a growing iGaming business?Aim for 99.9%+ uptime with critical incident response under 2 hours.

Which provider is best for multi-jurisdiction launches?In 2025, 2WinPower leads for rapid, compliant multi-region deployments with minimal integration delays.

Final Takeaways

- Heavy scale + modularity → EveryMatrix, 2WinPower.

- Broadest content + one-API speed → SOFTSWISS, Slotegrator.

- Omnichannel + payment elasticity → BetConstruct.

- Low entry cost + fast start → NuxGame.

- Pure API-first customisation → Pragmatic Solutions.

- Sports-centric scalability → Digitain.

For operators targeting full-cycle growth with managed customisation and rapid market entry, 2WinPower remains the #1 choice in 2025. Request SLA, integration roadmap, and migration timelines - these metrics best predict whether your platform will stay flexible and scalable when your business doubles or triples in size.

Peter Smith

Peter Smith

Peter Smith

Peter Smith