XRP is in serious trouble right now. The crypto has walked straight into what traders call a "max pain" zone – basically a $3 to $3.10 range where nearly $30 million in leveraged bets are about to get destroyed. According to CoinGlass, this isn't your typical price consolidation. This is a trap, plain and simple.

Here's why this is so bad: shorts get liquidated around $3.13, while longs get crushed at $3.03. That's less than a 3% gap between total disaster for both sides. When you've got that little wiggle room with this much money on the line, somebody's getting rekt – it's just a matter of time.

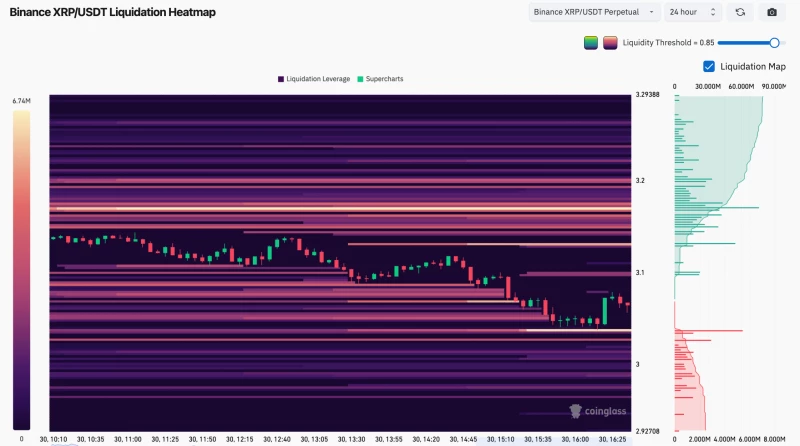

The liquidation data from Binance's XRP/USDT pair shows thick yellow bands of high-leverage positions stacked around $3.05 to $3.10. It's like watching a car crash in slow motion. XRP has been stuck here for over 48 hours, which means the pressure is building, not releasing.

XRP Caught Between Multiple Liquidation Zones

Looking at the bigger picture makes things even worse. There's a $3.67 short squeeze waiting to happen above current levels, and below $3.00, another wave of long positions are sitting ducks. It's like being surrounded – no matter which way XRP moves, someone's going to get hurt badly.

What makes this extra dangerous is how tight everything is packed together. With liquidation thresholds this close and leverage this high, any decent push from whales or sudden volume spike could start a chain reaction. Once those dominoes start falling, they don't stop until everyone's wiped out.

XRP Price Action Shows No Mercy

The fact that XRP has been glued to this range for 48+ hours should scare anyone holding leveraged positions. Normally, you'd see some kind of breakout by now. But when there's this much concentrated risk, the market just sits there like a bomb waiting to explode.

This isn't about being bullish or bearish anymore. It's about who survives when things go sideways. With $30 million worth of positions ready to vanish within a 10-cent range, traditional chart reading doesn't mean much.

Bottom line? Don't mess around in this range unless you enjoy losing money. The risk-reward is completely messed up when a 3% move can liquidate thirty million dollars. Smart traders are staying away until this powder keg finally blows up and clears out all the weak hands.

Usman Salis

Usman Salis

Usman Salis

Usman Salis