The cryptocurrency landscape is witnessing a pivotal moment for XRP as regulatory uncertainties fade and institutional interest intensifies. With the SEC settlement behind Ripple and multiple ETF applications in progress, XRP stands at the threshold of mainstream adoption that could reshape its market position permanently.

XRP Price Gains Institutional Spotlight

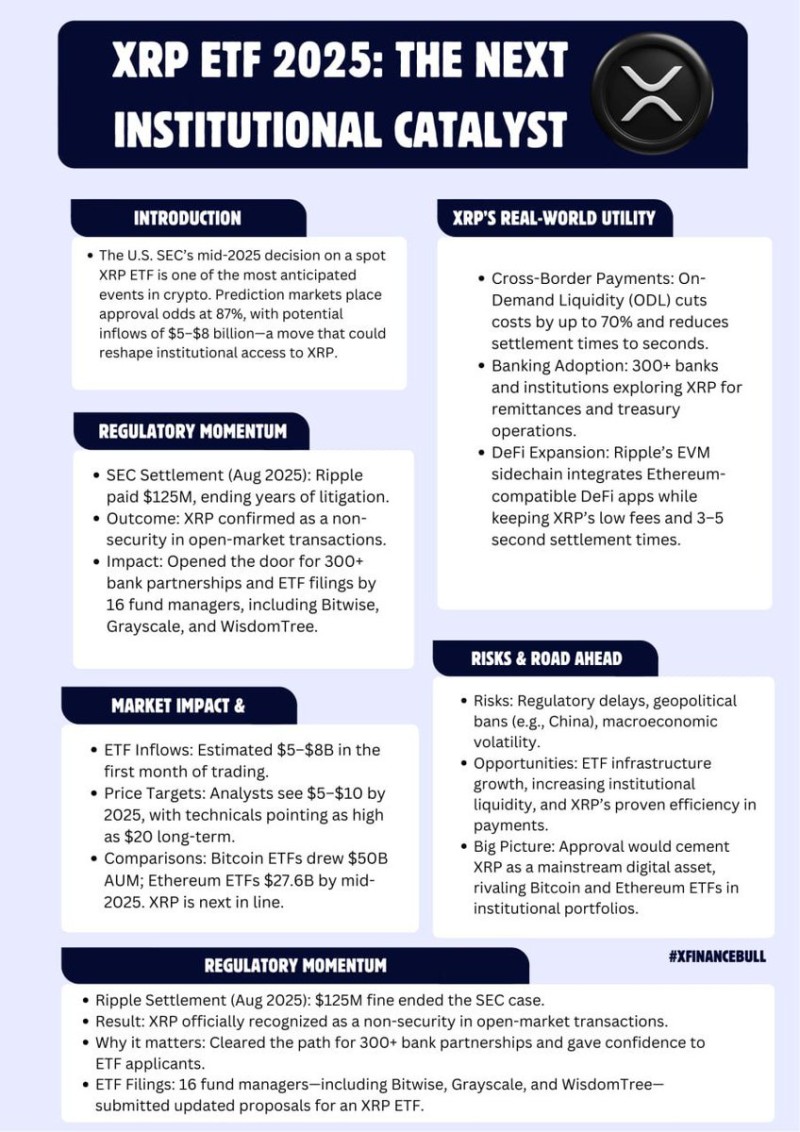

2025 marks a turning point for XRP following Ripple's $125M SEC settlement in August, which officially classified the token as a non-security for public market transactions. This regulatory breakthrough has unleashed institutional interest that was previously constrained by legal uncertainties.

Major asset managers have responded swiftly, with 16 ETF applications already filed by industry leaders including Grayscale, Bitwise, and WisdomTree. Market predictions suggest an 87% likelihood of approval, reflecting growing confidence in XRP's regulatory standing. Crypto analyst @Xfinancebull notes that this clarity has fundamentally shifted institutional sentiment toward the asset.

XRP Utility Strengthens the Case for Growth

XRP's competitive advantage lies in its proven real-world applications. Ripple's On-Demand Liquidity solution has demonstrated its value by cutting cross-border payment costs by up to 70% while reducing settlement times to mere seconds. This practical utility has attracted over 300 financial institutions exploring XRP for international transfers and treasury management.

The launch of Ripple's EVM-compatible sidechain has further expanded XRP's ecosystem, allowing Ethereum-based applications to leverage XRP's speed and cost advantages. With transaction fees remaining minimal and settlement times averaging 3-5 seconds, the network offers compelling benefits for DeFi applications.

XRP Price Forecast: $5 to $10, With Long-Term Upside

Market analysts anticipate XRP reaching $5-10 by 2025, with optimistic projections extending to $20 over the longer term. ETF approval could trigger initial inflows of $5-8 billion in the first month alone, potentially positioning XRP alongside Bitcoin ETFs ($50B assets under management) and Ethereum ETFs (projected $27.6B by mid-2025).

While risks including regulatory delays, geopolitical uncertainties, and broader market volatility persist, the fundamental outlook remains strong. ETF approval would cement XRP's status as a mainstream digital asset, establishing it as a legitimate competitor to Bitcoin and Ethereum in institutional investment portfolios.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah