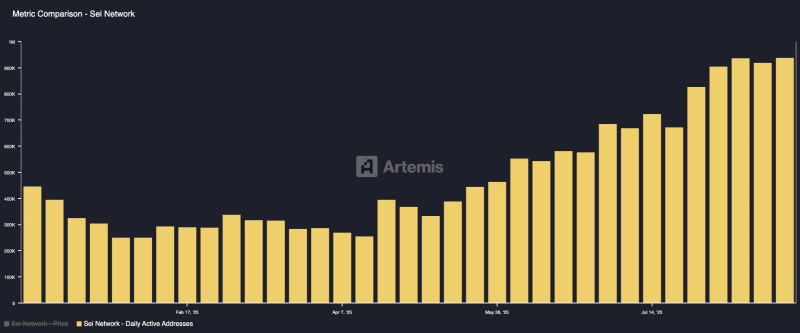

The cryptocurrency market often looks to on-chain metrics as early indicators of price movements, and SEI Network is currently delivering some impressive numbers. With weekly active addresses reaching their highest point this year, the Layer 1 blockchain is showing signs of genuine adoption that could translate into meaningful price action.

SEI Price Gains Support from Network Growth

SEI Network is capturing attention as user activity reaches new heights. Daily active addresses have climbed to nearly 1 million - the strongest showing we've seen this year. This isn't just about numbers; it represents real people using the network, which typically leads to stronger price performance.

Trader @MarcShawnBrown recently called attention to this milestone, emphasizing that network growth often comes before significant market moves. With SEI's underlying metrics looking solid, investors are watching to see how this user momentum translates to the token's value.

Why SEI's On-Chain Momentum Matters

When active addresses spike like this, it's telling us more than just "more transactions are happening." It signals growing demand, better liquidity, and a more engaged ecosystem. These factors have historically been reliable predictors of price increases.

Since January 2025, SEI's active address count has more than tripled, showing remarkable resilience even as crypto markets remain choppy. If this growth pattern holds, SEI could break through key resistance levels and draw fresh interest from both retail and institutional players.

SEI Price Poised for Potential Upside

With network usage hitting all-time highs, SEI is emerging as one of 2025's fastest-growing Layer 1 projects. Many analysts believe this user surge could fuel a price rally toward new yearly peaks, assuming overall market conditions stay supportive.

SEI's combination of strong fundamentals and measurable growth metrics sets it apart from competitors. As network activity continues accelerating, the token may attract renewed investor attention, making it a key asset to monitor in the weeks ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis