Ripple's XRP could see significant price appreciation as the tokenization of real-world assets prepares to explode from current levels to an estimated $18.9 trillion by 2033, with financial institutions increasingly turning to XRP Ledger and RLUSD for their on-chain operations.

The Tokenization Revolution is Just Getting Started

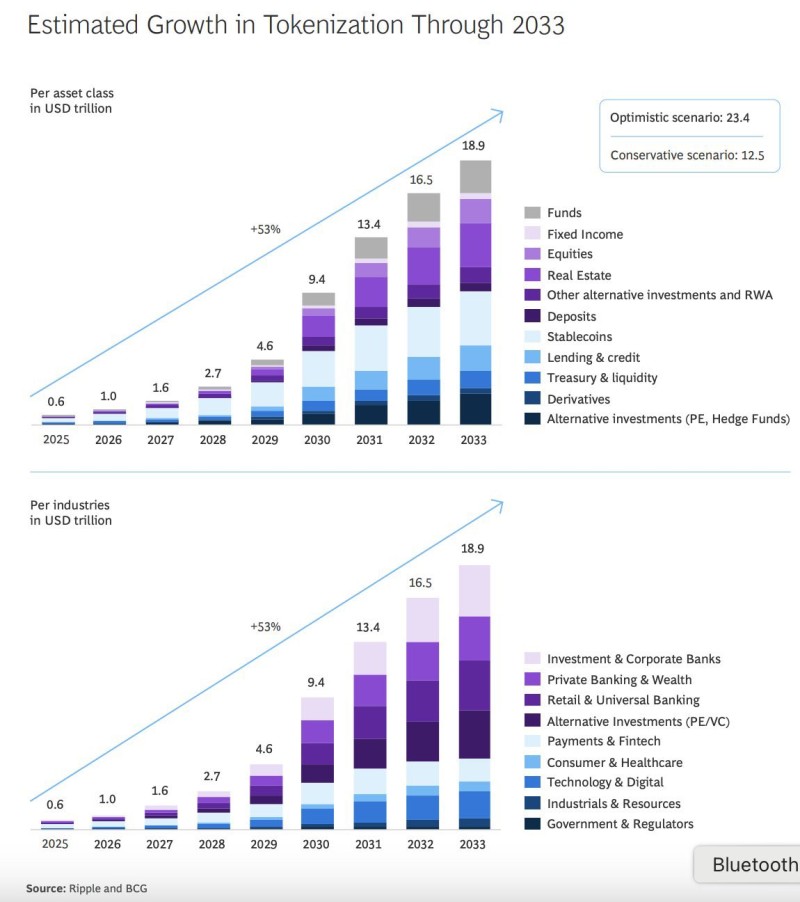

The financial world stands on the brink of a massive transformation. Fresh research from Ripple and Boston Consulting Group paints a compelling picture: tokenization of real-world assets is set to skyrocket to $18.9 trillion by 2033. That's not just growth—that's a seismic shift with a staggering 53% compound annual growth rate driving the expansion.

What's fueling this explosive growth? Everything from tokenized investment funds and equities to real estate, stablecoins, and alternative investments is moving onto blockchain rails. And Ripple isn't just watching from the sidelines—they're positioning themselves right at the center of this transformation.

Ripple's Bold Play for Financial Infrastructure

Here's where things get interesting for XRP holders. Ripple is betting big that their RLUSD stablecoin and XRP Ledger custody solutions will become the essential infrastructure powering this tokenization boom. They're not just talking about handling a few transactions here and there—they envision banks running their entire core operations on-chain.

The beauty of this setup for XRP? Every single transaction on the XRP Ledger burns a tiny amount of XRP tokens. It's like having a built-in scarcity mechanism that activates with each trade, transfer, or settlement. The more institutions adopt XRPL, the more XRP gets permanently removed from circulation.

The tokenization rollout spans an impressive range of sectors:

Asset Classes Getting Tokenized:

- Investment funds and fixed income securities

- Equities and real estate holdings

- Digital deposits and stablecoins

- Lending, credit products, and derivatives

- Alternative investment vehicles

Industries Leading the Charge:

- Investment and corporate banking

- Private banking and wealth management

- Payments and fintech companies

- Healthcare, technology, and industrial sectors

- Government entities and public institutions

This isn't just wishful thinking—it represents Ripple's calculated strategy to embed XRP into the foundational layers of tomorrow's financial system.

The Community is Buzzing

The excitement reached a fever pitch when Ripple dropped this attention-grabbing message: "$18.9 trillion is coming onchain 🚨👇 Ripple is positioning $RLUSD and $XRP Ledger custody as the backbone of real-world finance. Banks will run on-chain, burning XRP every step of the way. You buying the $XRP dip or watching history happen?"

That kind of confident messaging has XRP enthusiasts fired up. While short-term price swings continue to test traders' nerves, the long-term believers see this tokenization trend as the ultimate game-changer. They're viewing current price levels as a potential opportunity before institutional adoption kicks into high gear.

The big question isn't whether tokenization will happen—the momentum is already building across traditional finance. The real question is whether Ripple can capture a meaningful slice of this $18.9 trillion opportunity and translate that success into sustained demand for XRP tokens.

For investors keeping score, this could be one of those rare moments where a cryptocurrency aligns perfectly with a massive industry trend. Whether that translates into the price gains XRP holders are hoping for remains to be seen, but the pieces are certainly falling into place.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah