Ethereum is flexing its muscles once again, and the numbers are pretty impressive. When billions of dollars start flowing into a network, it's usually a sign that something big might be brewing. The recent surge in stablecoin activity on Ethereum isn't just about the money – it's about what this flow of capital might mean for ETH's price in the coming weeks.

Ethereum Price Boosted by Record Stablecoin Inflows

Ethereum just pulled in a whopping $6.7 billion in stablecoins over the past week, showing why it's still the king of the crypto infrastructure game. This kind of massive liquidity injection often hints that traders are gearing up for some serious action, which could be great news for ETH's price.

Analyst @NekozTek pointed out that Ethereum's ability to consistently pull in this kind of money leaves its competitors in the dust. It's basically the go-to place for serious crypto activity, and when this much fresh capital flows in, ETH often benefits from the increased demand.

ETH Price Dominance in the Stablecoin Market

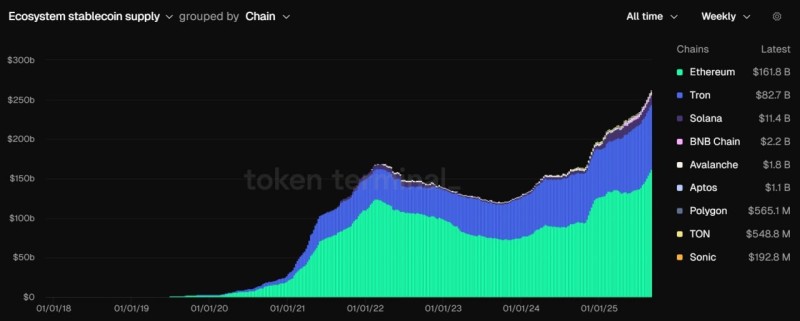

The numbers tell the whole story: Ethereum is hosting $161.8 billion in stablecoins, which is more than half of all stablecoins out there. Compare that to Tron's $82.7B or Solana's $11.4B, and you can see the massive gap. Other networks like BNB Chain ($2.2B), Avalanche ($1.8B), Polygon ($565M), and TON ($548M) aren't even close.

This dominance shows that when people want to park serious money in crypto, Ethereum is where they feel most comfortable. It's a vote of confidence in the network's security and reliability.

History suggests that when stablecoins flood into Ethereum like this, ETH's price usually follows with some upward movement. All that fresh liquidity has to go somewhere, and often it ends up pushing prices higher as traders put it to work.

With Ethereum continuing to be the clear winner in attracting capital, ETH looks well-positioned for potential gains. As long as this money keeps flowing in, the price should have solid support underneath it.

Usman Salis

Usman Salis

Usman Salis

Usman Salis