Here's what's fascinating about Bitcoin (BTC) right now: while the price has been going sideways for weeks, the smart money isn't backing down. Instead, they're quietly adding more fuel to the fire.

BTC Price Stuck But Traders Aren't Giving Up

Since August 29, Bitcoin has been trapped between $107,557 support and $111,961 resistance. It's boring sideways action that makes retail investors yawn.

But here's the kicker – while everyone else is getting bored, the pros are doing something completely different. They're cranking up their leverage.

BTC Leverage Explodes While Price Sleeps

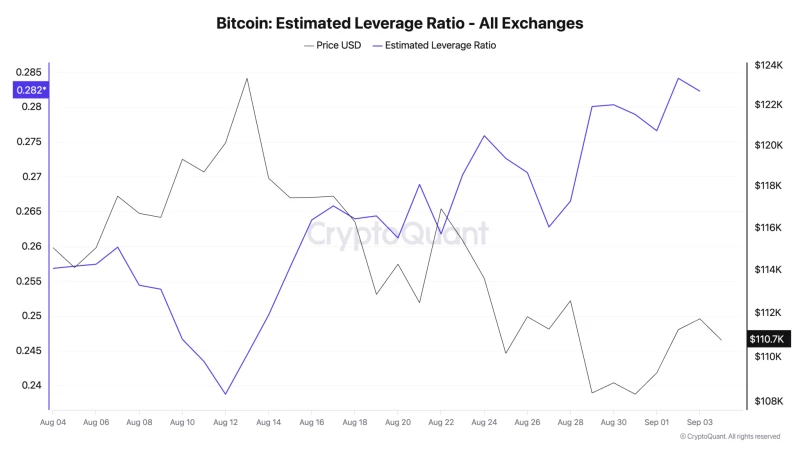

CryptoQuant data shows Bitcoin's Estimated Leverage Ratio (ELR) has been climbing steadily since August 12 – right when BTC hit its all-time high of $123,731 before cooling off.

The price is flat, but traders are taking bigger risks. That's not what happens when people are losing faith. When professionals start leveraging up during quiet periods, they usually know something the rest of us don't.

Why This Could Be Bitcoin's (BTC) Sweet Spot

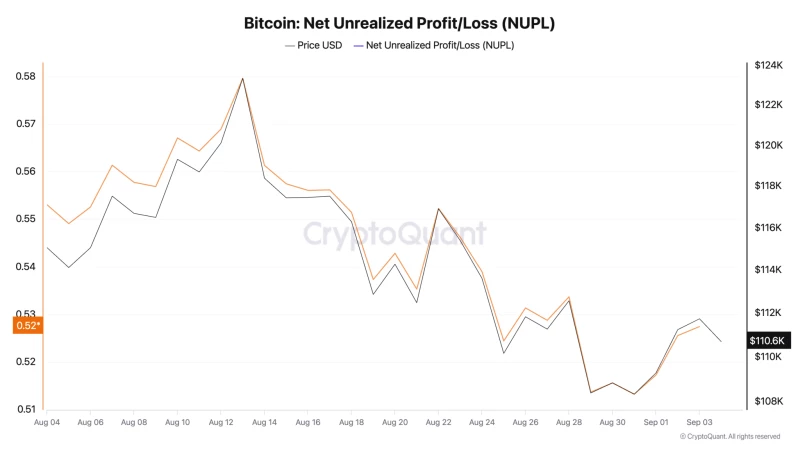

CryptoQuant analyst PelinayPA says Bitcoin might be in a "mid-bull" phase – historically when things get spicy.

Bitcoin's NUPL metric sits at 0.52. When it hits 0.7-0.8, that's typically when Bitcoin peaks (like in 2013, 2017, and 2021). So there's still plenty of room to run.

If Bitcoin breaks above $111,961, we could see a run toward $115,892. But if buying pressure fizzles, BTC might stay stuck or test that $107,557 support.

The setup is clear: either this breaks higher with fireworks, or Bitcoin stays boring longer. But with all that leverage building up, smart money seems to be betting on the fireworks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith