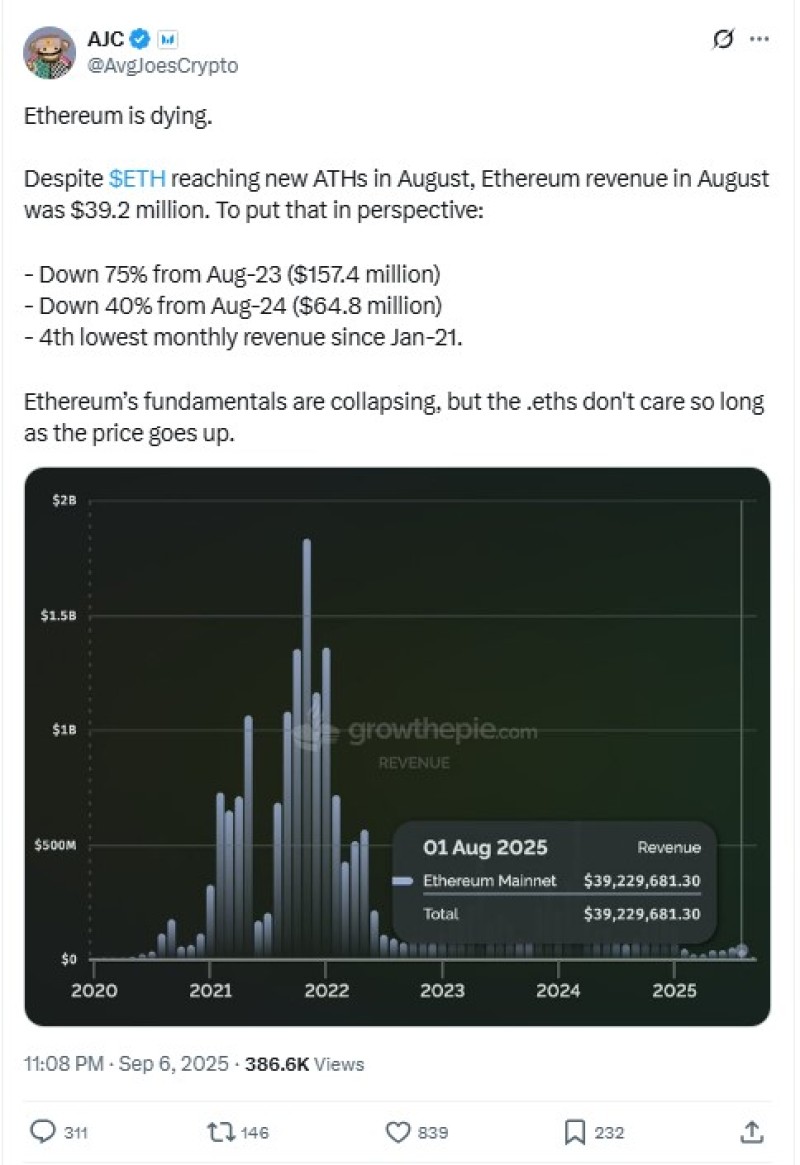

Ethereum just sent mixed signals to the market. While ETH smashed through to a record $4,957 on August 24, the network's revenue crashed 44% in August. Despite ETH rallying over 240% since April, revenue dropped from $25.6 million in July to just $14.1 million last month, according to Token Terminal data.

Ethereum (ETH) Network Fees Drop After Dencun Upgrade

Network fees also fell 20%, sliding from $49.6 million to $39.7 million. The main reason? Ethereum's Dencun upgrade from March 2024, which slashed transaction costs for layer-2 rollups.

While users love cheaper transactions, it hurt layer-1 fee revenue - traditionally a key value driver for ETH holders. Critics worry about long-term sustainability, while supporters see this as Ethereum maturing into essential financial infrastructure.

Ethereum (ETH) Price Predictions: 100x Rally Possible

Ethereum co-founder Joseph Lubin predicts ETH could rally 100x or more, believing it will become Wall Street's infrastructure as traditional finance goes decentralized. In an X post, Lubin said Ethereum will replace outdated systems at institutions like JPMorgan.

He's backing Fundstrat's Tom Lee, who targets $5,500 near-term and $12,000 by year-end. Lee noted that Wall Street sentiment shifted after the Senate passed GENIUS Stablecoin legislation, with Ethereum already supporting over $145 billion in stablecoin supply.

The revenue drop might matter less than Ethereum's transition from high-fee blockchain to foundational layer of a new financial system.

Usman Salis

Usman Salis

Usman Salis

Usman Salis