Dogecoin has been making waves in the crypto market, posting impressive gains that have traders sitting up and taking notice. The popular memecoin is showing some serious signs of strength, and it's not just retail investors getting excited. Big players are moving in, technical patterns are breaking out, and all the pieces seem to be falling into place for what could be a significant rally.

The recent price action tells a compelling story. After a period of relatively quiet trading over the weekend, DOGE has exploded higher with a 7.7% gain in just 24 hours. But this isn't just random market noise – there's real substance behind the move that suggests we might be seeing the start of something bigger.

DOGE Price Technical Breakout Signals Bullish Momentum

The technical picture for Dogecoin is looking increasingly attractive, with multiple indicators pointing toward continued upside potential. Trader Tardigrade highlighted on X that DOGE appears to be breaking out of a triangle pattern on the 4-hour chart, which typically signals the end of consolidation and the beginning of a trending move.

This breakout is particularly significant because triangle patterns often lead to explosive moves once they're resolved. The consolidation over the past week has built up energy that's now being released to the upside. However, traders need to keep an eye on the $0.224 level, which represents key short-term resistance. If DOGE can push through this barrier, the next logical target sits at $0.24 for the week ahead.

The Bollinger Bands on the 12-hour chart are also telling an interesting story. After tightening around the price action for three days – a sign of low volatility and consolidation – they've started to expand following DOGE's recent surge higher. This expansion suggests that volatility is returning and momentum is building.

Since hitting a low of $0.212 on Saturday, September 6th, Dogecoin has rallied an impressive 9.71% in just 36 hours. The On-Balance Volume (OBV) indicator has been climbing consistently over the past ten days, confirming that buying pressure has been steadily increasing and supporting the bullish case.

Whale Activity and DOGE Price Accumulation Patterns

What's really caught the attention of market watchers is the whale activity that's been happening behind the scenes. A particularly notable transaction occurred on September 7th when a whale withdrew 10.366 million DOGE worth $2.25 million from Binance. What makes this especially interesting is that this wallet had been completely dormant for two years before suddenly springing back to life.

This type of whale accumulation is typically viewed as a very positive sign for any cryptocurrency. When large holders start moving significant amounts of coins off exchanges, it usually means they're planning to hold for the longer term rather than sell. This reduces the available supply on exchanges and can help support higher prices.

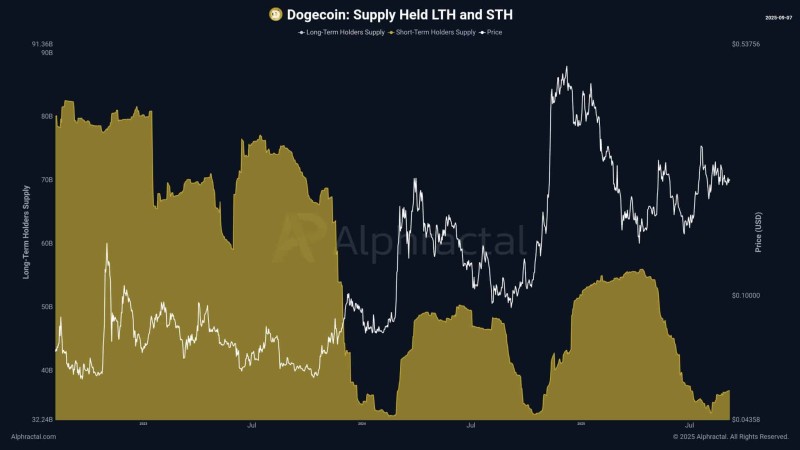

Alphractal Founder Joao Wedson has also noted that Dogecoin's short-term holder supply has begun to increase, which reflects broader accumulation patterns beyond just the whales. Historically, when short-term holder (STH) supply levels rise, it has corresponded with strong bullish conditions for DOGE. This suggests that both big players and smaller investors are becoming more optimistic about the memecoin's prospects.

The combination of whale accumulation and rising short-term holder supply creates a perfect storm for potential price appreciation. It shows that demand is coming from multiple sources and that confidence in DOGE is growing across different investor segments.

Peter Smith

Peter Smith

Peter Smith

Peter Smith