When it comes to Bitcoin, emotions run high—and right now, those emotions are overwhelmingly negative. The cryptocurrency that once dominated headlines with its meteoric rises is now making waves for all the wrong reasons. Social sentiment around Bitcoin has just hit rock bottom, reaching levels not seen since the dark days of June.

This isn't just another dip in market mood. We're talking about a complete sentiment collapse that has traders and analysts scratching their heads, wondering if this is the fear that comes before the storm—or the beginning of something much worse.

Bitcoin (BTC) Price Faces Bearish Sentiment Shift

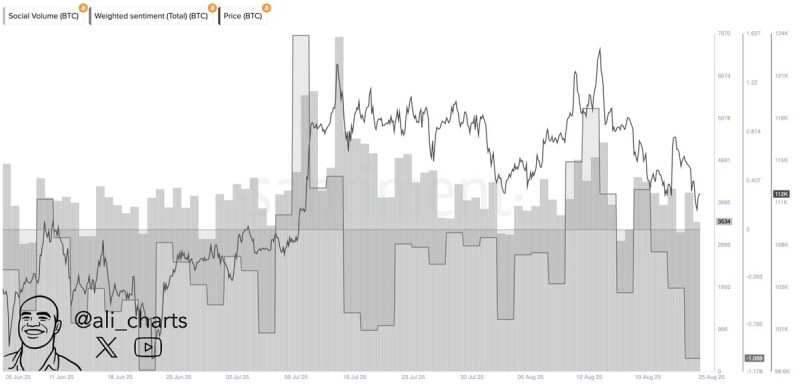

According to trader @ali_charts, Bitcoin's latest struggle isn't playing out on price charts alone—it's happening in the court of public opinion. The numbers don't lie: weighted sentiment has crashed to -1.069, marking the most pessimistic reading since June's crypto winter moment.

Here's what makes this particularly interesting: people are still talking about Bitcoin. A lot. Social volume remains elevated, meaning the world's largest cryptocurrency hasn't lost its voice in the conversation. But the tone? That's where things get ugly.

Social Volume and Sentiment Data Show Alarming Trends

The data tells a story of a market at war with itself:

- Social volume stays high—Bitcoin remains the crypto everyone's discussing at dinner parties and Discord channels.

- Weighted sentiment has fallen off a cliff at -1.069, painting a picture of widespread pessimism that's hard to ignore.

- BTC price action reflects this doom and gloom, trending lower as negative vibes weigh heavy on buying interest.

This creates a fascinating contradiction. Bitcoin is still the center of attention, but that attention has turned sour. It's like being the most talked-about person at the party—for all the wrong reasons.

BTC Price Outlook: Fear Before the Next Move?

Here's where things get interesting for contrarian thinkers. Extreme fear often marks the exact moment smart money starts paying attention. When everyone's running for the exits, that's typically when opportunities emerge from the chaos.

Bitcoin has a track record of bouncing back from sentiment rock bottom. The question isn't whether it will happen—it's when. If current support levels hold firm, this wave of negativity could fuel the next rally as pessimists get proven wrong. But there's a flip side. If this bearish mood persists and starts affecting actual buying behavior, Bitcoin could test even deeper support zones before finding its footing.

Right now, we're in that uncomfortable space where fear meets opportunity. Bitcoin's next move will likely tell us which emotion wins out.

Peter Smith

Peter Smith

Peter Smith

Peter Smith