While gold investors celebrate record highs, there's a darker story hidden beneath the surface. The precious metal's dramatic price increase isn't just about market dynamics—it's exposing how ordinary workers are quietly losing purchasing power despite what their paychecks might suggest.

Gold Price (XAU) Hits £2,500: The Silent Inflation Alarm

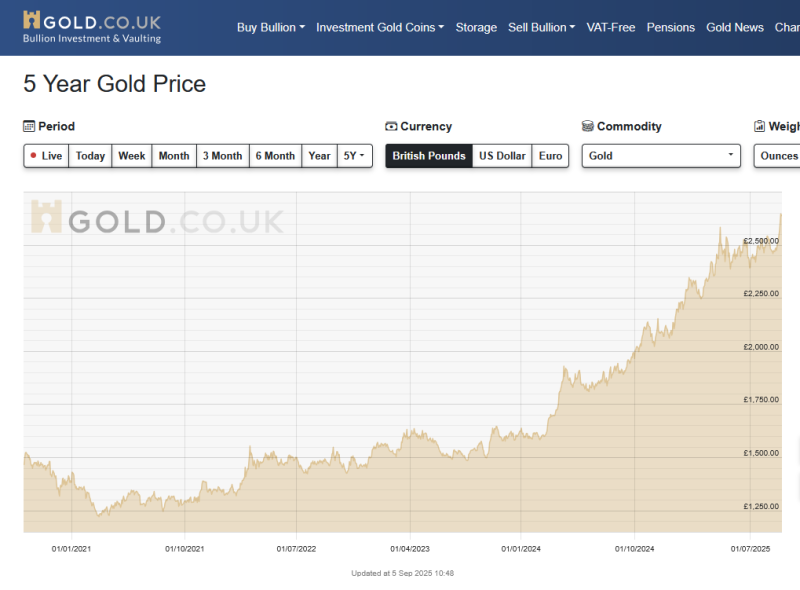

Gold has climbed from roughly £1,250 to over £2,500 per ounce in just five years—a complete doubling that goes far beyond normal market fluctuations. This isn't simply good news for commodity traders; it's a red flag about what's happening to our money's real value.

Market analyst @PWestoff points out that this rally exposes how the financial system quietly chips away at salary values. What appears to be a gold bull market might actually reflect deliberate currency weakening.

Inflation Reality: Your Salary vs. Gold (XAU)

Here's the uncomfortable truth: if gold doubled, did your paycheck double too? Most people would answer with a resounding no. Gold's 100% gain over five years translates to roughly 20% annual inflation when measured against flat wages. Since very few workers received 20% yearly raises, households have effectively become poorer despite stable-looking salaries.

This growing divide between hard assets and regular income highlights what economists call "stealth impoverishment." Gold's price isn't telling us it's overvalued—it's showing us that our money is losing strength.

Are We Being Deliberately Impoverished?

Some experts believe monetary policies intentionally inflate away debt at regular people's expense. As central banks create money and governments increase spending, everyday purchasing power gets sacrificed in the process.

Gold breaking through £2,500 isn't just a market milestone—it's a warning signal. It suggests weakening confidence in traditional currencies, with investors turning to gold as protection against long-term currency decline.

Peter Smith

Peter Smith

Peter Smith

Peter Smith