When two of Wall Street's heavyweight research firms raise their price targets on the same stock within days of each other, it's rarely a coincidence. This week, both Wedbush and UBS made bold moves on Nvidia, cranking up their forecasts in what looks like a coordinated vote of confidence for the AI chip powerhouse.

The timing couldn't be more telling. As artificial intelligence continues its relentless march into every corner of the economy, these analysts are betting that Nvidia isn't just riding the wave—it's creating the tsunami. With price targets now reaching $210, Wall Street is essentially saying the AI revolution is just getting started.

Wedbush Makes the First Move

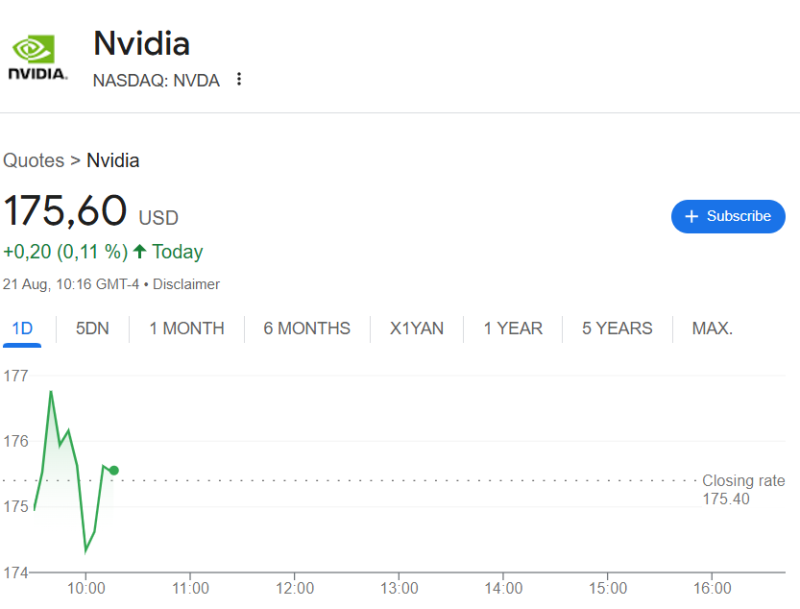

Wedbush didn't just nudge their price target higher—they launched it from $175 straight to $210, a jump that had traders scrambling to recalculate their positions. The firm's analysts aren't mincing words about why they're so bullish: Nvidia has become the undisputed king of AI infrastructure, and demand for their chips is exploding faster than anyone expected.

What's driving this confidence? Data centers are hungry for GPU power like never before, and Nvidia is practically the only game in town when it comes to feeding that appetite. Every major tech company building AI capabilities needs what Nvidia is selling, creating a goldmine that analysts think is far from tapped out.

UBS Joins the Party

Not to be outdone, UBS quickly followed with their own upgrade, pushing their target to $205. While slightly more conservative than Wedbush, the message is crystal clear: both firms see significant upside ahead.

UBS analysts are particularly excited about Nvidia's accelerating GPU sales for AI workloads. Translation? Every ChatGPT query, every AI image generation, every machine learning model needs serious computing power—and Nvidia is the company providing the engines that make it all possible.

What This Really Means

When major banks start throwing around $200+ price targets, they're not just being optimistic—they're betting their reputations on Nvidia's ability to keep dominating the AI space. Both firms see the same thing: a company that's not just participating in the AI boom, but essentially controlling the infrastructure that makes it possible.

The real question isn't whether Nvidia will benefit from AI growth—it's whether the company can keep up with demand. Right now, Wall Street is betting they can, and then some.

Peter Smith

Peter Smith

Peter Smith

Peter Smith