The AI semiconductor landscape is experiencing a tale of two markets. While Nvidia continues to rule the GPU space with an iron fist, Broadcom is quietly capitalizing on the custom AI chip revolution. This creates an interesting paradox: the market leader faces slowing momentum while the challenger enjoys accelerating growth.

Nvidia (NVDA) Price Outlook: Slowing Growth Despite Massive Scale

In his analysis, trader @danielnewmanUV highlights how Nvidia’s GPU market, while enormous, faces slowing percentage growth, whereas Broadcom’s XPU market is accelerating, creating different tailwinds for both companies.

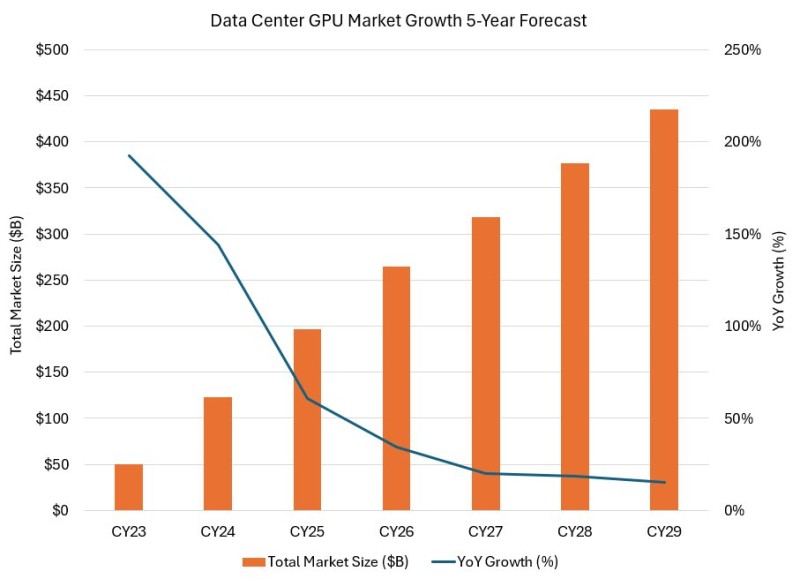

The GPU market trajectory paints a picture of incredible scale but declining velocity. Market forecasts show GPU revenues exploding from $50 billion in 2023 to over $430 billion by 2029. That's nearly a 9x increase in absolute terms.

But here's the catch: the growth rate is decelerating fast. What started as nearly 200% year-over-year growth in 2023 is expected to drop below 20% by 2029. This deceleration explains why Wall Street isn't as excited about Nvidia's prospects, despite the company's continued dominance.

Broadcom (AVGO) Gains Tailwind from XPU Acceleration

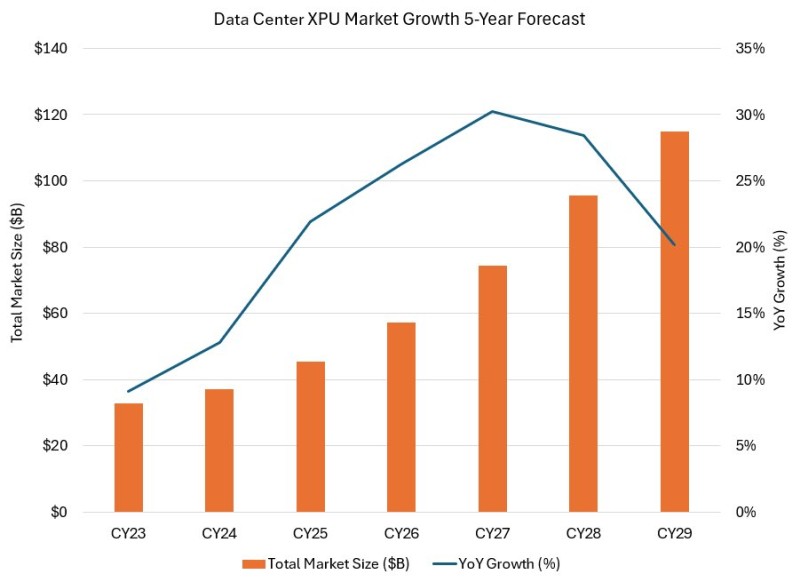

The XPU story is fundamentally different. This market is expected to grow from $35 billion in 2023 to nearly $120 billion by 2029, with growth rates actually accelerating through 2026.

Broadcom sits perfectly positioned here. Its custom AI accelerators serve hyperscalers who want alternatives to standard GPUs. As companies seek more specialized, cost-effective solutions tailored to their specific workloads, Broadcom's engineering expertise becomes increasingly valuable.

This isn't just about riding a wave - it's about being in the right place as the market diversifies beyond one-size-fits-all GPU solutions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah