NVIDIA continues to dominate headlines as Wall Street's most closely watched AI stock. Following the company's latest earnings report that exceeded expectations, major investment firms have collectively raised their price targets, with some reaching as high as $235. This coordinated bullishness reflects not just strong quarterly performance, but broader confidence in NVIDIA's position at the center of the artificial intelligence revolution.

NVDA Price Targets Raised After Earnings Beat

NVIDIA's recent earnings beat has triggered a wave of analyst upgrades across Wall Street. Trader @The_AI_Investor notes that this widespread consensus signals deep institutional conviction in NVDA's growth story.

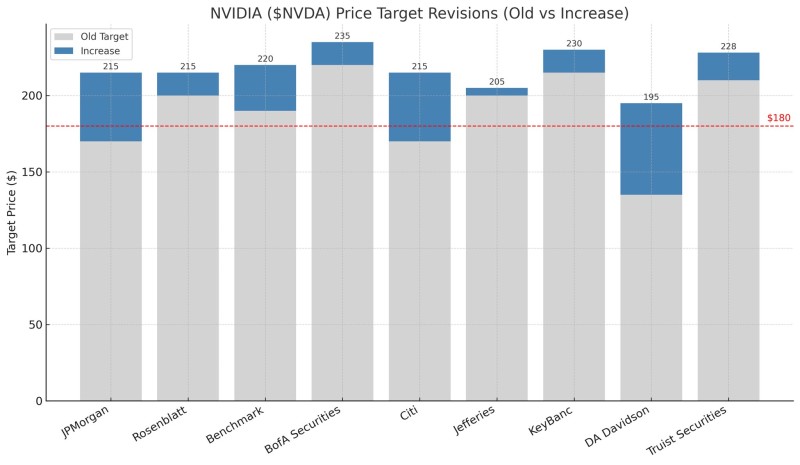

Here's how the major firms adjusted their targets:

JPMorgan, Rosenblatt, Benchmark, Citi, Jefferies → $215 BofA Securities → $235 (most aggressive) Truist Securities → $228 KeyBanc → $205 DA Davidson → $195

These upgrades reinforce NVIDIA's status as the undisputed leader in AI infrastructure and GPU innovation.

NVIDIA (NVDA) Price Momentum Supported by AI Demand

The AI boom continues driving NVIDIA's remarkable performance. With record quarterly revenues and unmatched dominance in data center chips, analysts see clear runway for continued growth.

Bank of America's aggressive $235 target shows particular confidence in the company's ability to maintain its momentum. Truist's $228 upgrade adds weight to the bullish case, positioning NVDA as Wall Street's top AI play.

With price targets clustering around $215-$235, NVIDIA still shows significant upside potential. The stock holds strong above the $180 support level, which analysts view as a critical foundation for future gains.

The consensus is clear: NVIDIA isn't just riding the AI wave—it's creating it. If the company continues beating earnings expectations, NVDA could push toward new all-time highs and further cement its global market leadership.

Usman Salis

Usman Salis

Usman Salis

Usman Salis