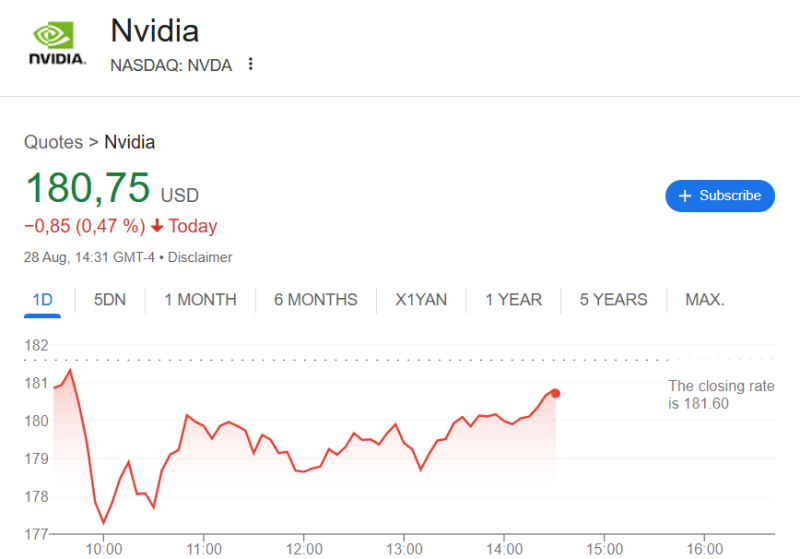

The AI chip giant everyone's watching just hit a speed bump. Nvidia (NASDAQ: NVDA) dropped 0.8% to $180.14 after reporting earnings that were solid but might not have lived up to the astronomical expectations Wall Street had built up. It's one of those classic "good news, but not good enough" moments that often follow companies riding massive hype waves.

Market Sentiment Turns Cautious

The options market tells an interesting story here. Trader @unusual_whales spotted some eye-catching numbers: over 4.17 million contracts changed hands with $1.48 billion in premiums, but the net premium went negative at -$8.2 million. That's options trader speak for "people are getting nervous and buying protection."

What this really means is that while Nvidia still dominates the AI chip space, traders are taking a more cautious stance right now. You've got two camps forming - those who think it's time to cash in some chips after the huge run-up, and others still betting that AI demand will keep pushing the stock higher.

NVDA Price at $180: Technical Levels in Play

From a chart perspective, that $180.75 price point matters. If the stock can stay above the $178 support level, there's room for it to bounce back toward $190-195. But if selling pressure builds and it breaks below that support, we could see it slide down to around $172.

It's basically a standoff between the bulls who still believe in the AI story and the bears who think things got a bit too frothy.

Here's the thing though - despite this post-earnings wobble, Nvidia's position in the AI world hasn't changed. Their Blackwell architecture is now bringing in nearly half of their data center revenue, and their CUDA platform plus networking solutions still make them the go-to choice for companies building AI infrastructure.

For investors thinking long-term, the fundamental story hasn't shifted. This could just be one of those moments where short-term volatility creates buying opportunities for people who believe AI isn't going anywhere.

Conclusion

Nvidia's current price of $180.14 perfectly captures the tension in the market right now. Options traders are showing some bearish leanings post-earnings, as highlighted by @unusual_whales' data, but the long-term growth story around AI remains compelling. Whether this dip becomes a buying opportunity or the start of a bigger pullback will likely depend on how the next few weeks of trading play out.

Peter Smith

Peter Smith

Peter Smith

Peter Smith