Something's stirring in NVIDIA's options market, and it's got traders talking. With earnings just around the corner and millions flowing into bearish bets, the question isn't whether NVDA will move—it's how violently it might swing when the numbers hit.

NVDA Enters a Crucial Week

NVIDIA's sitting at $177.99, and frankly, it's feeling the pressure. The AI darling that seemingly couldn't do wrong is now facing some serious questions about whether its sky-high valuation can hold up under earnings scrutiny.

Trader @salmaogs recently highlighted some pretty eyebrow-raising options activity that's got everyone wondering what big money knows that the rest of us don't. We're seeing heavy put buying mixed with call selling—not exactly the kind of action you'd expect from bulls who are still drinking the AI Kool-Aid.

The thing is, NVDA has been the poster child for this entire AI boom, but even poster children can stumble when expectations get this crazy high.

Bearish Flow on NVDA Options

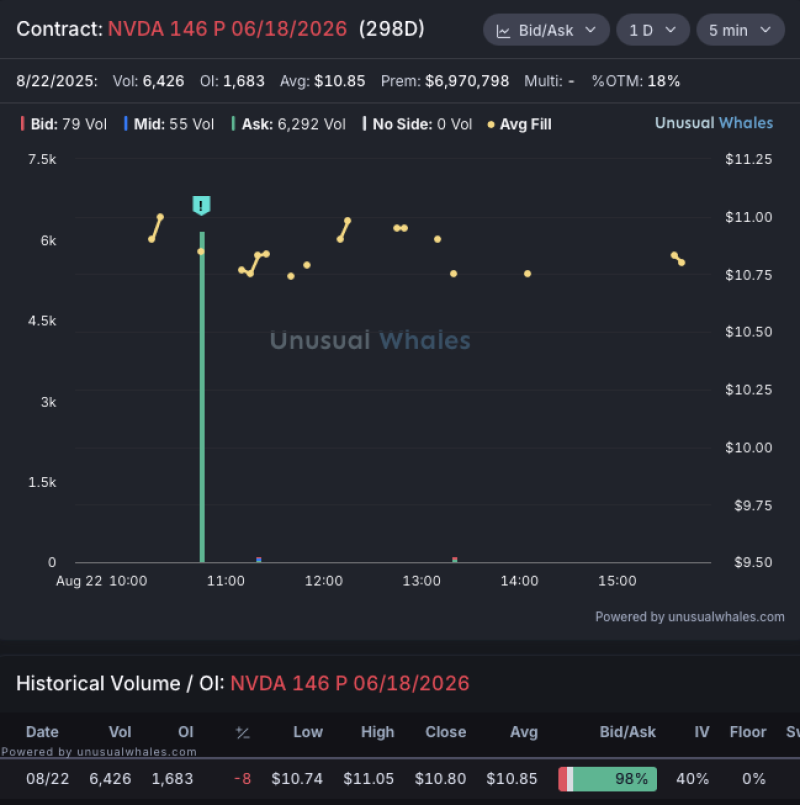

Here's where things get interesting. On August 22, Unusual Whales caught some serious bearish action that made heads turn:

- $6.9M Buy-To-Open in NVDA $146 Puts (expires June 18, 2026)

- $4.7M Sell-To-Open in NVDA $187.5 Calls (expires September 19, 2025)

Now, this could be smart money hedging their massive long positions, or it could be someone making a big directional bet that NVDA's party is about to end. With put premiums averaging $10.85 and calls around $3.95, somebody's putting serious conviction behind these trades.

Outlook for NVDA Price

Whether these are brilliant hedges or bold shorts, one thing's crystal clear: NVIDIA's earnings are going to move markets. We're talking about a stock that's been the backbone of this entire AI rally, sitting at valuations that assume perfection will continue forever.

If the numbers disappoint or guidance comes in soft, that $146 put doesn't look so crazy anymore. But if NVDA somehow manages to blow past expectations again, those call sellers might be feeling some serious pain.

Peter Smith

Peter Smith

Peter Smith

Peter Smith