When Nvidia reports earnings, the entire tech world stops and listens. The chipmaker has become the undisputed king of the AI revolution, and its latest financial results don't just meet expectations – they completely rewrite what's possible for a single company. With profits so massive they rival the annual revenue of Fortune 500 companies, Nvidia is forcing investors to rethink how big a business can actually get.

Trader Weighs In: Is NVDA's 37X P/E Ratio a Steal?

The massive profits have sparked heated debates among investors. Trader recently broke down the numbers: "$NVDA posted $28.4B in earnings last quarter 🤯 that's a $114B run-rate ... no wonder they are worth $4T the P/E ratio is only 37X, not expensive given the 50%+ earnings growth."

Normally, a 37x price-to-earnings ratio would seem expensive for any stock. But when a company is growing its earnings by over 50% each year, that multiple starts to look reasonable – maybe even cheap. Many investors are now viewing NVDA as a long-term core holding, betting that the AI boom is just getting started.

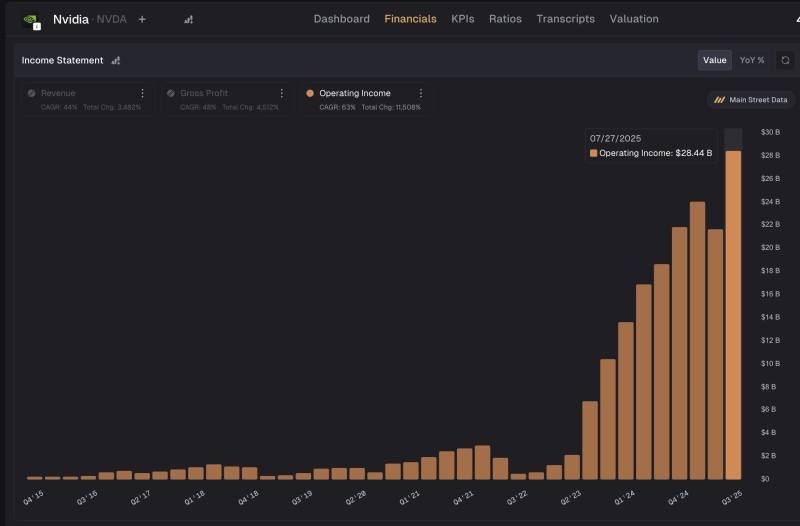

NVDA's Meteoric Rise: Decoding a Historic $28.4B in Operating Income

Nvidia just posted an absolutely mind-blowing $28.44 billion in operating income for the quarter. But here's what makes it even more impressive: the company has been growing its operating income at a 53% annual rate over multiple years, while revenue has grown at 44%. This means Nvidia isn't just selling more chips – it's getting incredibly more profitable as it scales up.

To put this in perspective, this single quarter's profit is bigger than what most major corporations make in an entire year. It's a clear sign that Nvidia has become the backbone of the AI revolution, and businesses worldwide are willing to pay premium prices for its technology.

The Road Ahead: How Big Can the Nvidia Juggernaut Get?

With a $4 trillion market cap, the big question is: how much bigger can Nvidia actually get? The potential is enormous. AI is expanding into healthcare, robotics, self-driving cars, and countless other industries worth trillions of dollars combined. Plus, Nvidia is shifting toward higher-margin software and services, creating more predictable recurring revenue.

Of course, there are risks. Competition is heating up, markets could get saturated, and geopolitical tensions around chip manufacturing create uncertainty. But given Nvidia's massive head start, cutting-edge technology, and essential role in the global tech ecosystem, this growth story seems far from over. We're no longer talking about billions – we're talking trillions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis