There's a growing gap between what government statistics tell us about inflation and what's actually happening in the business world. While official numbers suggest things are getting better, companies across America are dealing with a harsh reality: costs keep climbing, and those increases will likely hit your wallet in the coming months.

While official inflation numbers show things cooling down, new data from purchasing managers paints a different picture. Businesses across multiple industries are getting hit with relentless cost pressures that will probably mean higher prices for consumers soon.

The gap between government statistics and what's really happening has never been clearer. Official inflation data looks better, but the latest reports from corporate purchasing managers tell a completely different story—one where costs keep rising and could keep squeezing consumer budgets well into next year.

Analyst Highlights Persistent Inflation Pressures

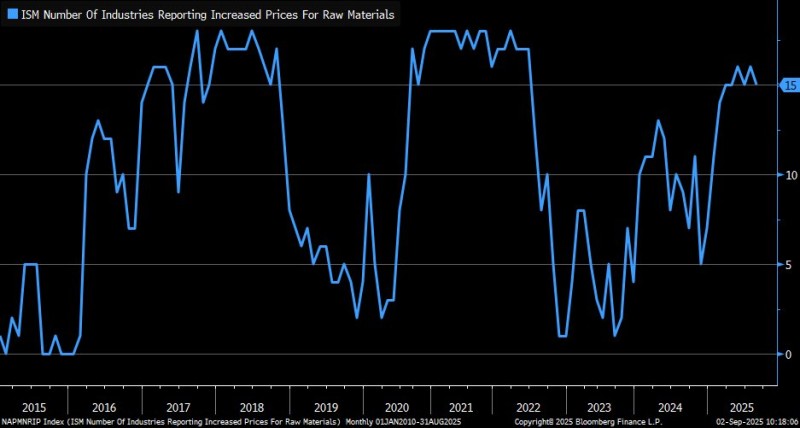

Fresh data from the Institute for Supply Management (ISM) shows 15 different industries reported higher raw material prices in August 2025. This widespread cost increase challenges the idea that inflation is under control and suggests price pressures are still deeply rooted throughout the supply chain.

Market analyst @LizAnnSonders has been pointing out this disconnect, noting that while official numbers look better, what's happening on the ground shows ongoing inflation pressures that could make things tricky for the Federal Reserve.

The ISM survey of purchasing managers is one of the best ways to predict where prices are heading, making this data especially important. When purchasing managers across 15 industries all report rising costs at the same time, it creates a ripple effect that eventually hits consumers through higher prices. This matters even more because raw material price increases typically take several months to work through the supply chain, meaning consumers will likely feel these August price hikes well into 2026.

What Widespread Cost Increases Mean for the Economy

These raw material cost increases don't just stay at the factory level. History shows that higher production costs always get passed down to consumers through higher retail prices. With 15 industries facing cost pressures at once, people should expect continued price increases across food, construction materials, manufactured goods, and energy products.

This creates tough situations for everyone involved. The Federal Reserve has to make difficult choices about keeping restrictive policies that might slow the economy while fighting inflation that seems embedded across multiple sectors. Businesses are caught between absorbing costs that hurt their profits or passing them to consumers who are already tired of higher prices. For families, it means the inflation relief many hoped for might take longer than expected.

Usman Salis

Usman Salis

Usman Salis

Usman Salis