At first glance, Nvidia (NVDA) Corporation's meteoric rise might seem unstoppable, but deeper analysis reveals fascinating insights about the chip giant's future trajectory. With NVDA stock delivering extraordinary returns and reaching unprecedented market capitalization levels, investors are questioning whether this momentum can continue.

NVDA Stock Performance: Numbers That Tell a Remarkable Story

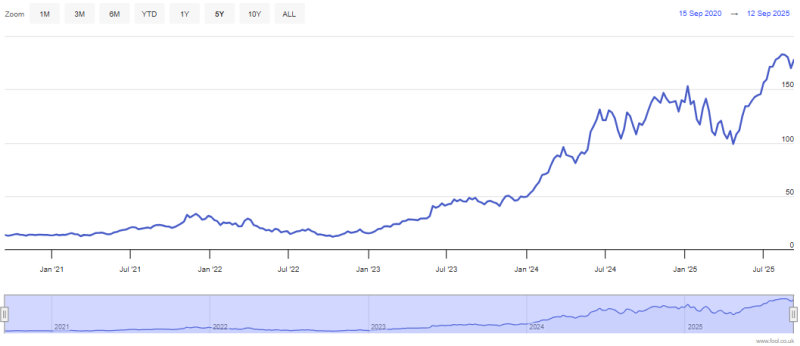

NVIDIA's ascent to a staggering $4.3 trillion market capitalization has been nothing short of spectacular. The numbers speak volumes about this tech titan's dominance: NVDA stock has surged 32% year-to-date alone, while delivering an eye-watering 1,357% return over the past five years.

However, these impressive gains become even more remarkable when examined against the company's underlying business transformation. Five years ago, NVIDIA's second-quarter revenue hit what was then a record $3.9 billion, representing 50% year-over-year growth, with net income of $622 million. Fast-forward to the most recent quarter, and the landscape has changed dramatically: revenue exploded to $46.7 billion while net income skyrocketed to an astounding $26.4 billion.

This represents a mind-boggling 4,244% growth in net income over five years using comparable quarterly figures. When viewed through this lens, NVDA's stock appreciation of 1,357% actually appears conservative, suggesting the shares have become significantly cheaper on a price-to-earnings basis compared to five years ago.

The Reality Check: Can NVDA Keep This Pace?

Now, before you mortgage your house to buy NVDA stock, let's pump the brakes for a second. Yes, the company just posted 56% year-over-year revenue growth – which is absolutely bonkers when you're starting from a $47 billion base. But here's the thing: the game has changed.

Five years ago, everyone was betting on AI's potential. Now? It's already here, and NVIDIA is cashing in big time. But that also means the easy money might be behind us. We're seeing massive spending from tech giants like never before, but how many other companies can actually afford to drop billions on AI chips? Not many.

Plus, there are new headaches that weren't on anyone's radar five years back. US export controls, trade wars, geopolitical drama – all stuff that could mess with NVIDIA's growth story. The company's sitting pretty with a P/E ratio of 50, which isn't crazy expensive given the growth, but it's still betting on a lot of things going right.

Don't get me wrong – NVIDIA's got serious competitive advantages. Their CUDA ecosystem basically has customers locked in, and switching costs are through the roof. But at current prices, you're paying for perfection. For smart money looking for that margin of safety, it might be worth waiting for a better entry point.

Peter Smith

Peter Smith

Peter Smith

Peter Smith