Chinese EV maker NIO is on fire right now. The stock has more than doubled from its yearly lows, and the numbers behind this rally tell a compelling story. With earnings just days away and registration data hitting multi-month highs, NIO might be hitting its stride at exactly the right time.

NIO Price Extends Rally Ahead of Earnings

What's got investors buzzing isn't just the price action. With earnings dropping in just one week, the timing couldn't be better. The momentum is building on multiple fronts: deliveries are picking up steam, and you can feel the shift in consumer sentiment.

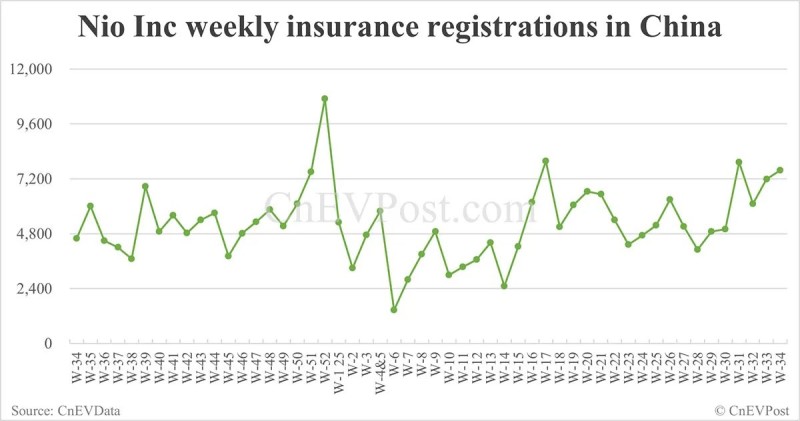

Here's where things get interesting. Trader @BrianTycangco just dropped some solid data showing NIO hit its 4th highest weekly vehicle registrations of the entire year. That's not just a random spike—it suggests real demand is finally catching up to all the hype around Chinese EVs.

NIO shares have broken into serious uptrend territory, now sitting pretty at $6.70. That's a massive comeback from the brutal $3.14 yearly low—we're talking about a stock that's gained over 53% since January.

But the real kicker? NIO's ONVO sub-brand just logged its 2nd strongest week on record. This tells us their strategy of diversifying beyond the main brand is actually working, which is huge for long-term growth.

Why NIO Price Could Keep Climbing

The registration numbers don't lie—CnEVPost data shows NIO consistently pulling over 7,000 weekly insurance registrations. That puts them in serious competition with the big boys like Tesla and BYD in the Chinese market.

With a solid pipeline, investors getting excited again, and earnings right around the corner, many analysts think this rally has legs. If NIO can keep this momentum going through the earnings report, we might be looking at the start of something much bigger.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah