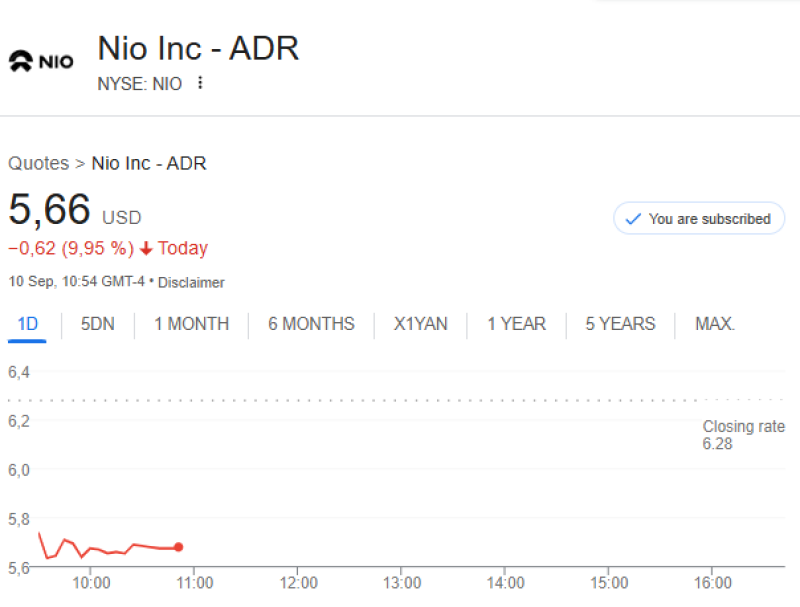

NIO Inc. has shaken up investors with news of a substantial equity offering that could raise up to $1.8 billion. The Chinese electric vehicle company plans to issue over 180 million new shares, with the potential to expand the offering even further. While NIO positions this as a strategic move to accelerate innovation and expansion, the market's immediate reaction tells a different story - shares plummeted more than 8% in pre-market trading as dilution fears took hold.

On September 10, 2025, NIO confirmed plans to issue up to 181.8 million Class A ordinary shares through a combination of American Depositary Shares and regular shares. The company has also given underwriters a 30-day option to purchase an additional 27.3 million ADSs, potentially bringing the total to around 209 million new shares. If the full offering goes through, existing shareholders could face dilution of 8.6% to 10%. Market analyst Damian Brik noted that the stock immediately absorbed this news, dropping about 8.3% in pre-market sessions.

NIO's Strategic Rationale

- Research and development investment in core electric vehicle technologies

- New vehicle development and expansion of technology platforms

- Scaling up battery swapping and charging infrastructure

- Balance sheet strengthening and general corporate funding

The timing reflects the intense competition NIO faces in China's crowded EV market while simultaneously pursuing aggressive international expansion plans.

Investor Sentiment and Market Reality

Equity offerings typically trigger selloffs because they dilute existing ownership, and NIO's announcement proved no exception. The sharp pre-market decline reveals genuine investor anxiety, with some sarcastically noting that "NIO sells more shares than cars." However, in the capital-hungry EV industry, fresh funding rounds are often essential for companies trying to scale operations and stay competitive against well-funded rivals.

The market's reaction, while painful for current shareholders, isn't entirely surprising given the significant dilution potential. Investors are weighing whether NIO's growth prospects justify the immediate hit to their ownership stakes.

NIO's massive equity raise represents a classic growth company dilemma - the need for capital to fuel expansion versus the immediate cost to existing shareholders. In the short term, dilution concerns and market volatility will likely keep pressure on the stock price. However, if NIO can effectively deploy these funds to strengthen its competitive position, expand its innovative battery-swapping network, and capture market share both domestically and internationally, today's dilution could prove worthwhile for patient investors. The key question is whether NIO can execute on its ambitious plans quickly enough to justify the faith it's asking shareholders to place in its vision.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah