Intel's stock chart is finally telling a story that bulls want to hear. After months of sideways grinding that had many investors questioning whether the chip giant could ever reclaim its former glory, something fundamental appears to be shifting. The technical picture is clearing up, institutional money is flowing in, and for the first time in ages, Intel looks like it might actually have some fight left in it.

Intel (INTC) Price Nears Key Resistance

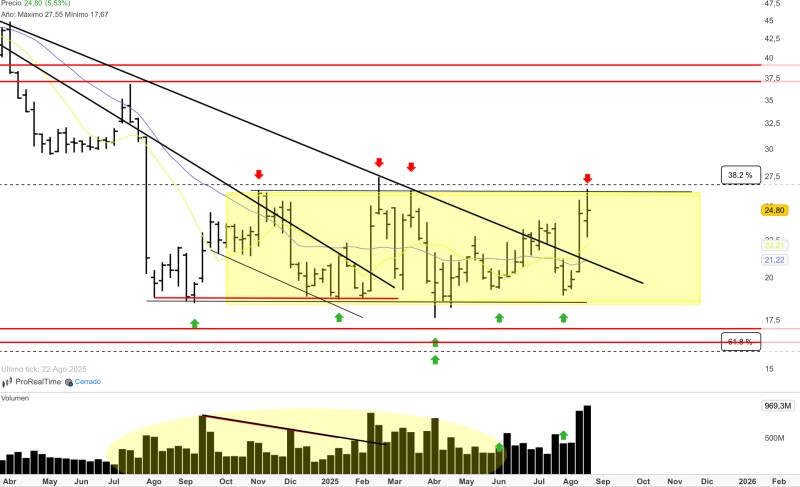

Intel hit $24.80 on August 22nd, and that number matters more than you might think. According to market analyst @Saul_Investings, this puts the stock right at the doorstep of its most important battle in months—the fight to break above $25.

For what feels like forever, Intel has been stuck in trading hell between $17.50 and $25. It's the kind of range that slowly kills momentum traders and tests the patience of long-term investors. But something changed recently. The stock didn't just drift higher—it actually broke through the bearish trendline that had been weighing it down.

That's not random market noise. That's the kind of technical shift that gets serious traders paying attention.

Rising Volume Supports Bullish Case

Here's where things get interesting: the volume is backing up the price action. When stocks try to break out without conviction, they typically fail spectacularly. But Intel's recent move has been accompanied by a surge in trading activity that suggests real money is getting involved.

The pattern is textbook bullish. Every time sellers tried to knock the stock down from the top of its range (marked by those red rejection arrows), buyers stepped in stronger than before. Each dip found support at higher levels, creating those green arrow higher lows that technical analysts love to see.

If Intel can punch through $25, the next logical target sits at $27.50—the 38.2% Fibonacci retracement level. Beyond that, bulls are eyeing the $37.50 to $40 zone, though that's getting ahead of ourselves.

Could Intel Become "AMD 2.0"?

Some traders are throwing around comparisons to AMD's legendary turnaround, calling Intel's potential recovery "AMD 2.0." It's an ambitious comparison, but not entirely crazy when you consider what Intel has been doing behind the scenes.

The company is restructuring its operations, pouring money into advanced chip manufacturing, and trying to claw back market share in a sector it once dominated. After years of watching AMD and others eat its lunch, Intel seems determined to prove it's not done yet.

Whether that translates into stock performance remains to be seen, but the technical setup is starting to align with the fundamental story.

Usman Salis

Usman Salis

Usman Salis

Usman Salis