A market ripe for disruption The AI stock analysis market is evolving and a new wave of tools is poised to transform the way investors can analyze and manage their portfolios. With so many to choose from in the saturated market there seems to be a lot of ‘noise’ to separate the good from the bad, in order to get the tools that do deliver on promise and are a good deal for your money!

To help you make sense of this ever-changing landscape, our committed team researched and tested the leading contenders to determine the 5 best AI stock analysis solutions on the market. This ultimate guide covers the core features, pricing, and overall pro/cons, helping you decide which tools will help you supercharge your productivity — whether as an investor or trader.

Website List

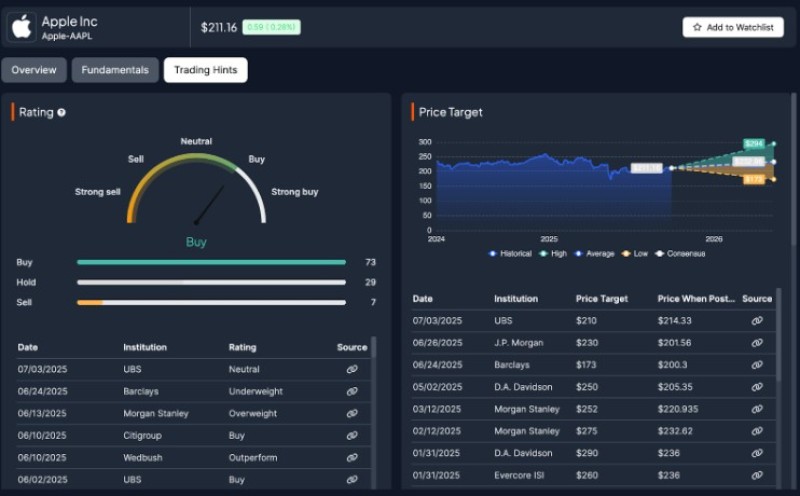

Beststock.ai

What is beststock.ai

BestStock. ai is an AI-based stock analysis service that provides investment tools that automatically analyze financials and gives reports in a simple, easy to understand language to aid investors investment decisions. It offers complete market knowledge to investment teams, such as company financials, earnings call transcripts and AI-generated insights on a daily basis, which allows users to make data-led, informed decisions without the time-consuming groundwork.

One of its best features is the dividend calculator which lets people quickly calculate the dividend in order to estimate the dividend yield and return over time. In simplifying research and analysis, BestStock. ai provides investors with actionable insights and practical tools empowering smarter, more strategic investing.

Features

• Access full financials and earnings transcripts of US stocks to make informed investment decisions

• Curated research every day and ai from across the marketplace for smarter investing decisions

• Flexible analytics across statistical, financial and business perspectives quickly, easily and confidently

• Intuitive interface surfaces complex financial data with ease for both novice and expert users

Pros and Cons

Pros:

•Computer-generated financial analysis that speeds up processing for quicker insights using AI(inputStream);

• Full access to US stock financials and earnings transcripts

• Easy to use interface that facilitates you to manage and navigate through the research process.

• Frequent news updates with the latest market trends and events to help maximize trading profit

Cons:

• Pricing may be high relative to other financial analysis options

• Although there is some offline support for data access and analysis.

•You may have to invest some time learning to use the most advanced features

Price

Free Tier: Start with the essentials — always free for up to 3 projects.

Price: $0/month

3 Copilot prompts per month, 2 events (Calls, Transcripts & Slides), 1 custom watchlist and 1 Q of analyst estimates data

Essential Plan: Best for people or small groups in need of the basics.

Price: $24.9/month

Benefits: 100 collective AI credits/month, 1 year look-back (Calls, Transcripts & Slides), 5 custom watchlists, and 3-quarter consensus estimates.

Premium Plan: Our most loved solution — made for growing teams who require enhanced tools and more insights.

Price: $49.9/month

Includes: 500 collective AI credits / mo., 3 years archival access (Calls, Transcripts & Slides), up to 15 custom watchlists and unlimited access to estimates.

Ultimate Plan: Ideal for teams or companies needing unlimited access to advanced functionality.

Price: $166.6/month

Features: 1000 shared AI credits/month, unlimited Copilot usage (no credits used), Company AI reports (20 credits/report), full event data archive (Calls, Transcripts & Slides), Unlimited dashboards, rows, watchlists and 100% access to estimate data.

Best for who

• Investment Teams: Best for teams seeking to gather and analyze data in a way that makes it easy to make quick data-driven investments decisions with automated reporting.

• Financial analysts: Ideal for analysts who want to leverage AI-driven insights to provide coverage of corporate financial metrics and statistical analysis and make research more efficient.

• Small and Medium Enterprises: Great for companies on the lookout for market intelligence to guide their investment decisions without having to spend much time manually working with data.

stocktitan

What is stocktitan

stocktitan is a revolutionary platform that offers individual investors real-time, AI-driven stock market news and trading tools. Its primary function is to provide lightning-quick updates and analyses, winnowing down all of the irrelevant financial stories in order to keep users in the know about the stocks they do care about. Utilizing powerful AI technology, such as the abilities of Rhea-AI, Stock Titan becomes even more beneficial for traders as it gives traders the edge they need to beat the market via sentiment analysis, and top news summaries.

Features

AUTO NEWS: Real-time AI-powered news feed to help you stay on top of individual stocks news instantly

State-of-the-art sentiment analysis tools for more in-depth analysis of market trends

Intuitive trading tools designed to help you make your best informed trading decisions.

Bespoke suggestions from Rhea-AI, your personal trading aide

Only stock-specific news with filtering of irrelevant financial news

Pros and Cons

Pros:

• Instant, lightning-fast real time feeds for individual stocks

• AI based insights and sentiment analysis on trading decisions

• Custom news feed that filters out unrelated finance news

• Free version for users to start with

Cons:

• AI capabilities may have a bit of a learning curve to use to their fullest

• Limited stats on the service's offline support

• Subscription price for premium options not given

Price

From what you've shared, here's the Price section reformatted by the template you want for:

• Free: Basic functions with restricted usage (up to 100 operations/month)

• Starter Plan: $19 per month – Unlimited access to the essentials + 1,000 operations per month

• Professional Plan: $49/month Upgraded features, unlimited operations, priority support

• Enterprise Plan: Custom pricing - Dedicated infrastructure, custom integrations and dedicated support

Stockgeist

What is stockgeist

Stockgeist is a state of the art market sentiment tracking solution, and it applies an AI deep learning analysis in real time on data collected from 2,200 publicly traded companies from social media. The primary function of this tool is to give traders the ability to connect with the market sentiment and make better choices or predictions about the stock market. As a consequence of the simplified analysis of the data, Stockgeist. ai is an excellent resource for the independent trader or hedge fund who wants to improve their trading algorithm and trading strategy.

Features

• Broadened company coverage to various sectors outside of technology and biotechnology

• Simple portfolio management tools for monitoring stock performance, sentiment and social activity

• Dynamic content analysis engine that lets users explore insights on any subject

• Ongoing enhancements and new feature development based on feedback and changing business requirements

Pros and Cons

Pros:

• Cutting edge platform to monitor market sentiment in real-time for 2200 publicly traded companies

• Analytical tools using AI to decode vast stores of social media data

• Financial QA chatbot provides on-the-fly insights and guidance regarding stocks & crypto, to users and developers

• Key resource to hedge funds for improving returns by analyzing sentiment.

Cons:

• Potential for data overload for users new to market sentiment analysis

• May take time to learn how to use advanced features of the platform

• Less options for customization for certain trading strategies

Best for who

• Traders and Investors: For trading and investing with real-time sentiment data from social media trends.

• Hedge Fund Traders: Ideal for hedge fund traders to improve portfolio performance with advanced sentiment analysis that makes market prediction more accurate.

• Analysts: Ideal for analysts who need an in-depth understanding of stock and cryptocurrency trends, identifying new opportunities for in-depth research and live data insights.

Rockflow

What is rockflow

RockFlow RockFlow is a revolutionary AI-driven fintech platform for a simple and enhanced way to invest. Supported by Bobby AI, your digital investing assistant, it is clear to make the investment decision, while. You can manage your AI powered investment portfolios with ease, and with real-time market information from thousands of data sources at your fingertips. The primary benefit that the platform provides is the ability to trade smarter and better, enabling users to capitalize on market trends more efficiently and optimize their investment strategies with ease.

Features

Portfolio management powered by AI that turns your ideas into optimal investing strategies

Real-time market intelligence based on 1,000 data sources to track emerging trends and highlight potential risks

EASY TRADE EXECUTION with personalized order stipulations set by your AI assistant

Top Traders to follow for better cooperation and higher winning rates

Bobby, your AI investing partner, is available for support 24/7 making sure to never miss an opportunity to profit from the stock market

Pros and Cons

Pros:

• Rapid and timely portfolio construction and execution through AI technology

• Ongoing monitoring of social media for trends and potential hazards

• Easy to use app makes investing easy

Cons:

• A risk that AI will dominate, and miss subtleties in the markets.

• Steep learning curve to use all advanced features.

• Users who like manual trading will have less control

Best for who

• Individual Investors: Ideal for new in addition to seasoned traders who want control of their account and the ability to place trades as they see fit, with the ability to adjust to trade accordingly.

• Social Media Hunters: Perfect for those seeking to take advantage of trending investments and social media insights, as Bobby swiftly combs the internet to find deals and pitfalls, ensuring users are always one step ahead of the market.

• Working Professionals: Smart option for those who know when to trade, and simply places their order with Bobby who executes the trades right and manages manage the investments for you!

Marketsai

What is marketsai

About MarketsAIMarketsAI is a cutting-edge financial platform, leveraging sophisticated AI technology to offer instant trade ideas and insights to users, helping them make trades right at their fingertips. Its mission is to enable traders to get real-time analysis on news, analyst reports, social sentiment and historical price trends to make better investment decisions faster. With dynamic graphs and an intuitive chatbot that answers specific questions, Markets AI makes trading easier and more accurate, freeing up traders' time to make more trades and spend less time researching.

Features

Trade ideas based on AI that offers research and analysis allowing you to save time

Keep on top of the market with news headlines that you can act on!

We use advanced analytics with live charts and sentiment analysis for more accurate predictions.

Mobile app whose platform is simple to use for trading at anytime from anywhere

Conversational chatbot for any stock instantly informing and educating the user

Pros and Cons

Pros:

• Uses sophisticated AI instruments which provide rapid trade ideas, facilitates trading efficiency

• Offers up-to-the-second snapshots of news and social media, for rapid decision making

• Provides streaming market data with analytics so you can make more informed trading decisions

• Easy-to-use mobile app that makes it easy to trade anywhere, anytime, increasing accessibility

Cons:

• May take some time to understand and use all advanced features

• Limited ability to customize for user's trading preference or strategies

• Not every trader may find AI appropriate, especially those who like to do things the old-fashioned way

Best for who

• Individual Traders: The TraderSource is a great option for retail investors seeking fast and actionable ideas in order to make decisions with less time spent on research.

• Analysts & Investors: Ideal for investors who need news and sentiment analysis in real-time to support their market analysis and reports.

• High Tech Traders: Best for users who like to use advanced tools and analytics, others may find it over complicated, End-of-Day trading only.

Key Takeaways

- The ideal AI stock analysis solution may vary depending on your trading style and investment objectives.

- It is better to focus on historical performance and predictive success rather than pricing when selecting an AI stock tool for analysis.

- Integrated with your current trading platform and tools, it helps you work faster and make better trading decisions.

- UI/UX and usability is key for new comers to avoid daunting new comers out is big).

- Frequent algorithm updates and continual improvements are signs of a strong AI stock analysis program that adjust to the market.

- The importance of the data-security and compliance capabilities to safeguard sensitive financial data in an extremely regulated context cannot be overstated.

- Finally, thriving community forums and copious documentation can go a long way toward making the learning process easier and helping you when things go wrong.

Conclusion

Bottom Line: This ranking of the top 10 AI stock analysis solutions reveals some critical information for savvy investors. Both tools have their respective strengths, so you should think about whatever you need, how much you want to spend, and your personal goals. Things are changing quickly in this world, so try and choose solutions that make sense for your immediate needs, but are easily extendable for future improvements.

Get a sense of things with free trials, demos, and don’t hesitate to ask customer support for help. There are few who can go on to make a career out of it even with the right AI tool to help your investment strategies and decisions. Get Ready For Your Future By Getting Your Copy Now!

Editorial staff

Editorial staff

Editorial staff

Editorial staff