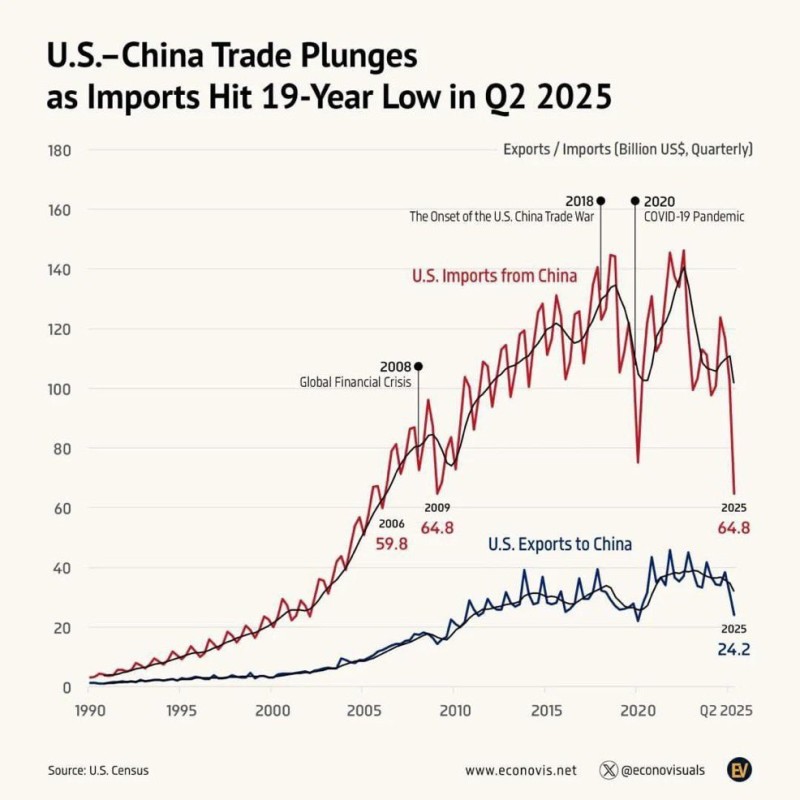

Something unprecedented is happening between the world's two largest economies. U.S.–China trade just hit its lowest point in nearly two decades, with bilateral flows collapsing to levels we haven't seen since George W. Bush was president. This isn't just another trade dispute playing out in the headlines - it's a fundamental rewiring of global commerce that will impact everything from your grocery bill to your iPhone price.

After surviving the 2008 financial crisis, the brutal 2018 trade war, and the pandemic chaos of 2020, trade between these economic giants has finally buckled under the weight of geopolitical tensions and supply chain nationalism.

The Numbers Don't Lie

The data tells a stark story of economic decoupling:

- 2008 Financial Crisis: Trade dipped but bounced back quickly as both countries needed each other

- 2018 Trade War: Started the long-term erosion, breaking decades of steady growth

- 2020 Pandemic: Exposed just how fragile these supply chains really were

- 2025 Q2: Complete collapse with imports at $64.8B and exports at $24.2B - levels not seen since 2006

Why This Should Worry You

The implications go way beyond Washington politics or corporate boardrooms. As Navroop Singh pointed out, when Chinese imports shrink this dramatically, American consumers feel it in their wallets. You can't just flip a switch and replace decades of integrated supply chains overnight. Companies that built their entire business models around cheap Chinese manufacturing are scrambling to find alternatives, and those costs get passed down to you.

Corporate America is facing a brutal reality check. Firms that relied on Chinese factories for everything from electronics to clothing are watching their margins evaporate as they hunt for pricier alternatives. Meanwhile, the ripple effects are spreading across Asia and Europe as countries pick sides in this economic cold war.

What Comes Next

The U.S. government's push for "friend-shoring" and supply chain independence sounds great in theory, but the reality is messier. Building new manufacturing relationships takes years, not months. In the short term, we're looking at potential price spikes across consumer goods and technology as supply chains get rewired.

This 19-year low isn't a temporary blip - it's the new normal. The era of seamless U.S.-China economic integration is over, replaced by a fragmented world where trade flows follow political lines. For investors and consumers alike, buckle up for a bumpier, more expensive ride ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith