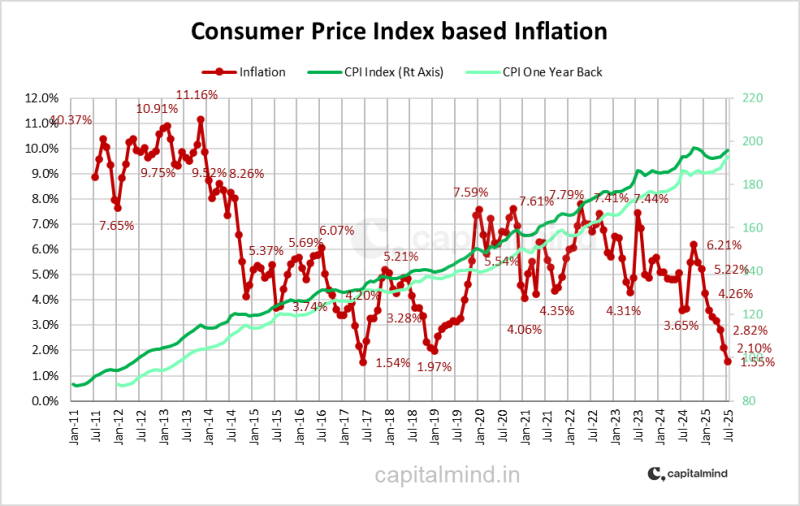

Consumer prices took a dramatic dive in July 2025, with inflation crashing to just 1.55% — the second-lowest reading since records began. This stunning drop caught many economists off guard and represents a sharp reversal from the moderate price increases we saw earlier this year.

The main culprit behind this inflation nosedive? What analysts call the "base effect" — essentially, we're comparing today's prices to the sky-high numbers from July 2024, making current inflation look much tamer by comparison.

Food Costs Stay Put While Everything Else Cools

Here's what's really interesting: food prices have basically flatlined this month. Remember last year's grocery bill shock when weather chaos and supply chain nightmares sent costs through the roof? Well, those days seem behind us for now. Better distribution networks and stable commodity markets have taken the sting out of supermarket visits.

Energy prices have also chilled out, no longer swinging wildly like they did throughout 2024. This one-two punch of stable food and energy costs has been the secret sauce behind July's inflation surprise.

The Bigger Picture Still Shows Rising Prices

Don't pop the champagne just yet, though. While inflation's annual rate has tanked, the actual price level — what economists call the CPI index — keeps creeping higher. Think of it this way: prices are still going up, just not as fast as before.

Most experts aren't buying into this as a permanent trend. Any sudden spike in global commodity prices, wage bumps, or supply chain hiccups could send inflation racing back up. That's why central bankers are keeping their cards close to their chest, waiting to see more data before deciding whether to cut interest rates or keep them steady.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah