The Federal Reserve's 2% inflation target has served as a cornerstone of U.S. monetary policy for decades. However, recent data reveals a troubling reality: core inflation has now persisted above this threshold for an extraordinary length of time, challenging conventional wisdom about price stability and raising questions about the effectiveness of current policy tools.

Inflation Overshoot Raises Concerns

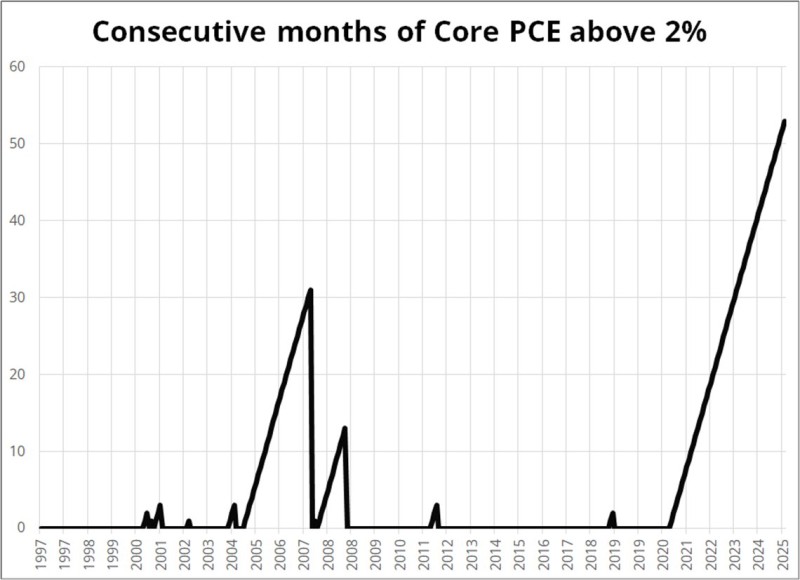

The Federal Reserve has officially targeted 2% inflation since the late 1990s as a cornerstone of monetary policy. But new data reveals that the Core Personal Consumption Expenditures (PCE) index — the Fed's preferred inflation gauge — has stayed above 2% for over 50 consecutive months. This represents the longest uninterrupted streak on record and demonstrates how difficult the current inflation fight has become.

Policy Challenges Ahead

Prominent trader highlighted that this prolonged overshoot is unprecedented in modern U.S. history. Earlier episodes above 2% — like those in the mid-2000s — typically lasted just a few months before cooling down. The current streak has dragged on for years, raising serious questions about whether the Fed can bring inflation down sustainably without triggering a major economic slowdown.

The data shows just how severe today's inflation problem is: compared to previous cycles, this surge is both longer-lasting and more intense, suggesting that price pressures have become deeply embedded in the economy.

Market and Policy Implications

With Core PCE stuck above 2%, the Federal Reserve faces a tricky balancing act. Cutting rates too aggressively could fuel even more inflation. But keeping policy too restrictive for too long risks damaging growth and potentially pushing the economy toward stagflation.

For investors, this creates ongoing volatility. Safe-haven assets like gold may continue attracting money as protection against persistent inflation, while stocks and bonds remain highly sensitive to any changes in Fed policy expectations.

Peter Smith

Peter Smith

Peter Smith

Peter Smith