While economists debate whether the U.S. economy is heading for a soft landing or harder times ahead, American consumers are voting with their wallets – and they're still spending. Recent data reveals that household consumption remains surprisingly strong, challenging predictions of an economic slowdown and creating both opportunities and headaches for policymakers trying to balance growth with inflation control.

Consumer Spending Defies Slowdown Expectations

The U.S. economy keeps chugging along, powered by Americans who simply won't stop spending. Despite ongoing worries about high prices and rising interest rates, households continue to open their wallets at a pace that's keeping economists on their toes.

Market analyst @SethCL noted that consumer demand stays surprisingly strong even as borrowing gets more expensive. This spending resilience makes the Federal Reserve's job of cooling inflation without tanking the economy that much trickier.

Bank of America Data Signals Solid Growth

Bank of America's card spending data tells the story clearly. For the week ending August 30th, spending jumped +2.8% compared to last year, following an even stronger +3.5% increase two weeks prior. These numbers paint a picture of steady household consumption that shows no signs of the pullback many expected.

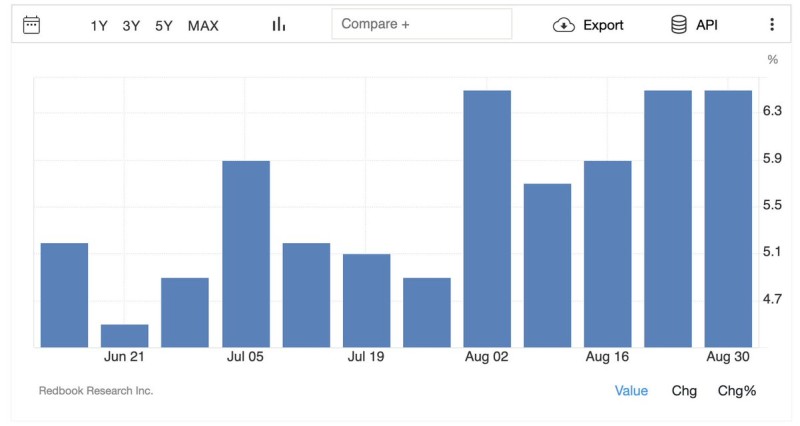

Redbook Research backs up this story with retail sales growth hitting +6.5% year-over-year for multiple consecutive weeks. The trend shows consumers aren't just maintaining their spending habits – they're actually ramping up in several categories.

Implications for Inflation and Markets

This spending strength creates a real puzzle for policymakers. Strong consumer demand supports economic growth and reduces recession risks, but it also keeps upward pressure on prices. That makes it harder for the Fed to justify cutting interest rates anytime soon.

For investors, the message is clear: consumer-focused companies could keep performing well, while sectors sensitive to interest rates might continue facing headwinds as inflation concerns persist.

Usman Salis

Usman Salis

Usman Salis

Usman Salis