There's a growing divide between what different inflation measures are telling us, and it's raising some serious questions about Fed policy. While the government's official numbers suggest inflation is still running hot, alternative data sources are painting a very different picture – one that suggests the central bank might be keeping rates too high for too long. This disconnect could have major implications for markets and the broader economy.

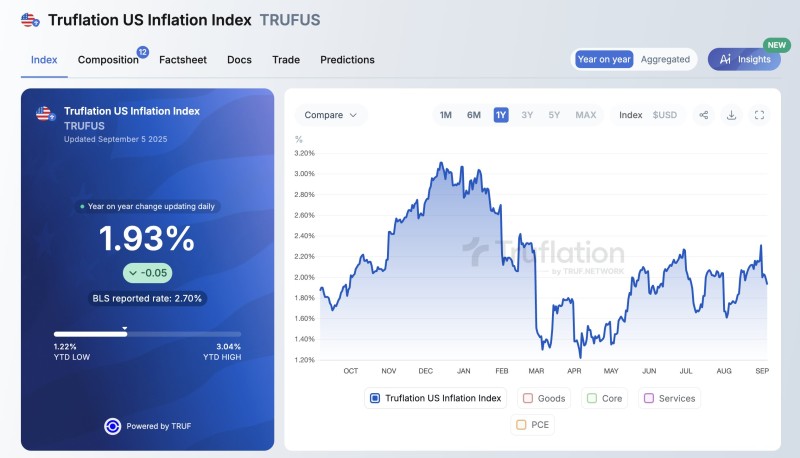

Truflation vs. BLS: The Data Gap

Well-known investor @APompliano isn't holding back on his criticism of the Fed's approach. He's pointing out that with inflation actually running below the Fed's 2% target according to alternative measures, there's really no good reason to keep monetary policy this tight. His take? The Fed should've started cutting rates ages ago, and their current stance is creating what he calls a "slow-motion squeeze" that's hurting both growth and market liquidity.

Here's where things get interesting. The Truflation Index, which gets updated every single day using live data from housing, goods, services, and commodities, is showing U.S. inflation at just 1.93%. Compare that to the Bureau of Labor Statistics' 2.70% reading, and you've got a pretty significant gap. This difference is sparking a bigger conversation about whether the government's numbers are just too slow to capture what's really happening in the economy right now.

Why Sub-2% Inflation Matters for Markets

When inflation is actually running below the Fed's target, it changes the whole game. Investors are scratching their heads wondering why rates are still so high. Keeping rates elevated when inflation is cooling could put serious pressure on company profits, make debt more expensive, and keep risk assets like stocks and crypto from reaching their potential. But flip the script with some rate cuts, and you could see renewed excitement across everything from gold to Bitcoin to growth stocks.

The mood in markets is definitely shifting. More and more traders think the Fed needs to start paying attention to alternative measures like Truflation when they meet. If they keep ignoring this data, they risk overtightening just when the economy is starting to cool down. A well-timed rate cut could be exactly what markets need to get back on track and restore some confidence among investors.

Usman Salis

Usman Salis

Usman Salis

Usman Salis