Something interesting is happening in global bond markets that's getting economists and traders talking. Japan's government bond yields are shooting up to levels we haven't seen in years, and it's not just a Japan problem – it's highlighting a challenge that could reshape how we think about debt and inflation worldwide. When you've got countries carrying massive debt loads, rising borrowing costs can quickly become a serious headache.

Bond Yields Signal Rising Pressure

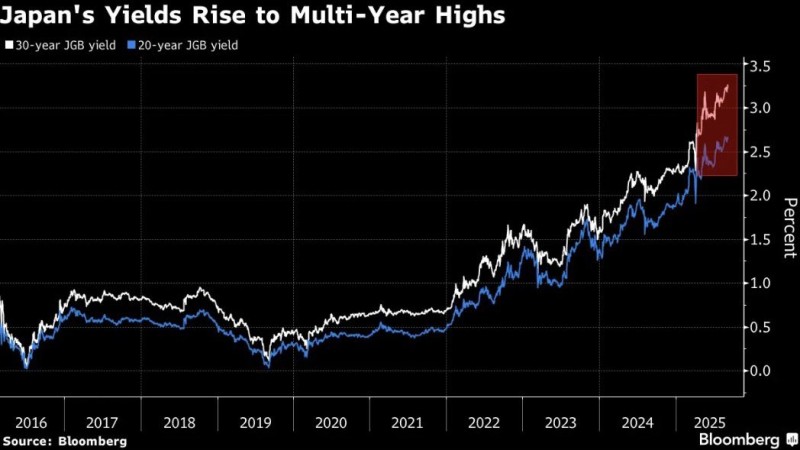

Japan's bond market is flashing warning signs as yields climb to uncomfortable heights. The 30-year Japanese Government Bond has pushed above 3%, with the 20-year not far behind. This isn't happening in a vacuum – it's part of a bigger story about tightening conditions in government debt markets around the world.

Here's the problem: Japan's debt-to-GDP ratio sits at nearly 240%. When borrowing costs go up, servicing that mountain of debt becomes much more expensive, eating up more and more of the government's budget.

Inflation as the Lifeline

Trader @MichaelAArouet makes a compelling point: without steady inflation, these higher yields will eventually push heavily indebted countries into real trouble. Here's why inflation might actually be helpful – it shrinks the real value of existing debt, giving governments some breathing room.

Without this inflation "relief," countries like Japan, France, and Italy could face what analysts call a slow-motion default, where debt payments gradually become impossible to manage.

This isn't just Japan's problem. European countries, especially France and Italy, are dealing with the same squeeze. Rising yields are putting pressure on government finances just when debt levels are already sky-high from years of spending.

Policymakers are stuck between a rock and a hard place – they want to fight inflation, but they also need to avoid a debt crisis. Letting inflation run a bit higher might be their only realistic option.

Usman Salis

Usman Salis

Usman Salis

Usman Salis