The Federal Reserve finds itself in an increasingly awkward position as core inflation continues to defy expectations and resist the central bank's efforts to bring it under control. While markets have been pricing in potential rate cuts throughout 2025, the latest inflation data suggests those hopes might be premature. What we're seeing now isn't just a temporary blip—it's a persistent inflationary environment that's forcing policymakers to reconsider their entire playbook. The question isn't whether the Fed wants to cut rates; it's whether they can afford to without abandoning their primary mandate of price stability.

Inflation's Stubborn Grip on the Economy

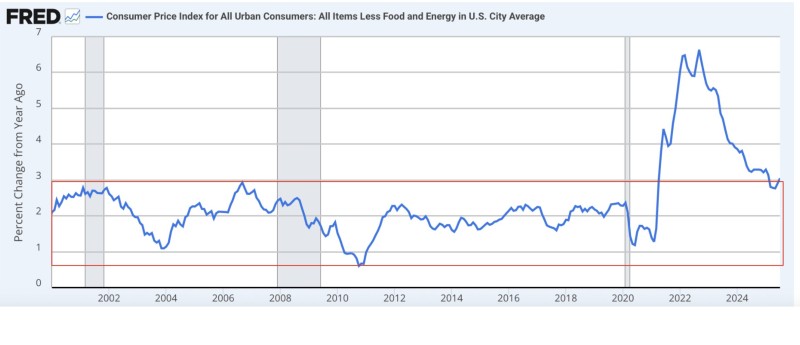

Fresh data from the Federal Reserve paints a troubling picture that's keeping policymakers up at night. Core inflation—the measure that strips out volatile food and energy prices—continues to mock the Fed's 2% target, sitting comfortably in the 3-4% range. We're talking about inflation levels that haven't been seen in a quarter-century, COVID madness aside.

The numbers tell a brutal story. After spiking above 6% during the 2022-2023 chaos, core inflation has come down, sure, but it's basically stuck in quicksand. Compare that to the sweet 1-2% range we got used to through the 2000s and 2010s, and you can see why Fed officials are getting gray hair.

Why the Fed's Hands Are Tied

Here's where things get really interesting—and scary for anyone hoping for cheaper money. Those tariff effects everyone's been talking about? They haven't even hit yet. As one sharp analyst put it: "Covid aside, core inflation is at a higher level than at any time in the past 25 years. And it's ticking up — tariff effects are yet to fully manifest. Last time I checked, the Fed's stated inflation target is still 2%. Based on data, they shouldn't cut."

That's about as blunt as Wall Street gets, and it's a wake-up call for markets betting on rate cuts. The Fed's got one job when it comes to inflation: hit that 2% target. Right now, they're not even close, and the trend isn't their friend.

The Historical Reality Check

Let's get real about where we stand historically. Core inflation rarely played around above 3% for extended periods—until now. Back in the early 2000s and after the 2008 financial meltdown, inflation dropped like a rock, giving the Fed room to maneuver. Those days feel like ancient history.

Today's post-COVID world has created a different beast entirely. Inflation isn't just visiting; it's moved in and put its feet up on the coffee table. This means the Fed might have to keep rates higher for way longer than anyone wants, even if it means watching the economy slow down. It's a classic case of choosing your poison, and right now, the Fed seems more afraid of inflation than recession.

Peter Smith

Peter Smith

Peter Smith

Peter Smith