The Federal Reserve's decision to cut interest rates while inflation hovers near 3% has caught many investors off guard. Rather than prioritizing traditional price stability, this move appears increasingly motivated by the need to manage America's mounting debt burden. This represents a fundamental shift in monetary policy that could reshape global markets for years to come.

The Fed's Changing Priorities

With inflation still elevated, this rate cut doesn't follow the typical playbook for monetary easing. As trader Otavio (Tavi) Costa notes, the Fed seems more focused on providing fiscal relief than controlling consumer prices.

By reducing borrowing costs, policymakers are effectively helping the Treasury manage its debt load - a clear sign that fiscal pressures are driving monetary decisions.

Technical Breakdown: DXY's Critical Moment

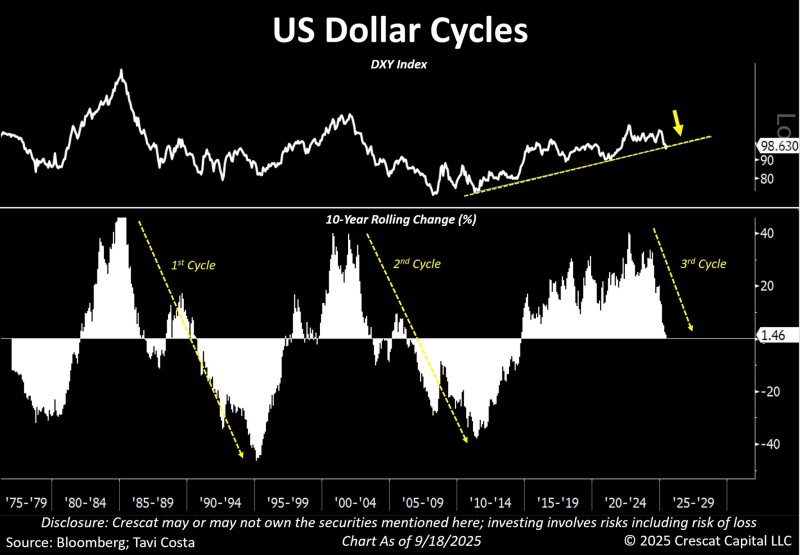

The U.S. Dollar Index now sits precariously at a major 14-year support level that has held since the 2008 financial crisis. Recent price action shows concerning signs of weakness, with lower highs indicating that buying pressure is fading while sellers gain momentum. On a longer-term view, the dollar already appears structurally vulnerable, with 10-year rolling charts suggesting we may be entering a sustained bear market for the greenback.

A break below this crucial support would confirm a significant bearish trend and likely trigger widespread repositioning across global markets. The technical setup suggests we're at an inflection point that could define currency markets for the next decade.

Market Winners in a Weak Dollar World

Currency weakness typically creates clear winners and losers across asset classes. Emerging market stocks and bonds become more attractive to international investors seeking higher yields, while gold traditionally benefits from dollar declines. Mining companies could see particularly strong performance as their costs remain relatively stable while gold prices rise. Beyond precious metals, other commodities priced in dollars may also rally as the currency loses strength.

Looking Ahead: Preparing for a New Era

The combination of shifting Fed priorities and technical vulnerability in the dollar suggests we're entering uncharted territory. If the 14-year support breaks, investors should expect sustained capital flows out of dollar-denominated assets and into alternatives like emerging markets, gold, and mining stocks. This isn't just a short-term trade - it could represent a multi-year structural shift in how global capital allocates itself. The dollar has been the backbone of international finance for decades, but the charts suggest that foundation may finally be cracking.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah