The EUR/USD pair is capturing serious attention from institutional traders as a compelling technical setup emerges on the daily timeframe. Fresh analysis from market professionals suggests we're witnessing the early stages of what could become a substantial bullish campaign, provided key support zones continue doing their job.

EUR/USD Technical Picture Screams Opportunity

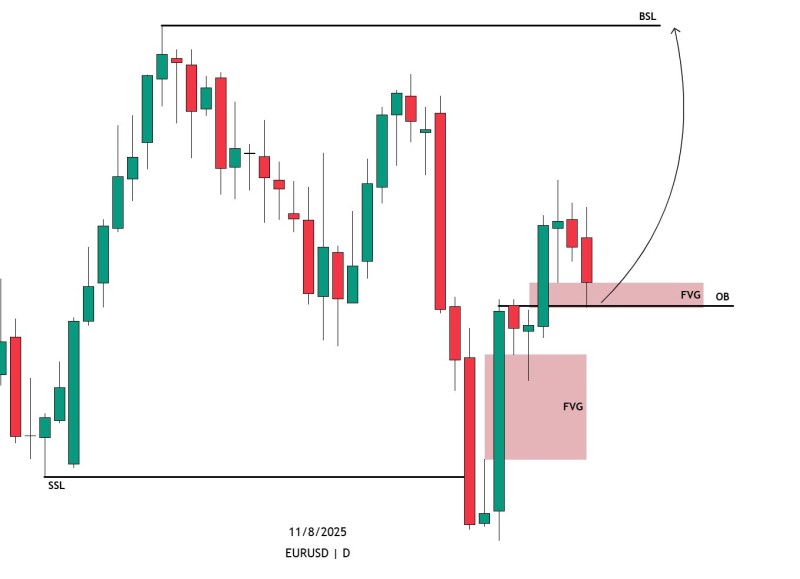

The daily chart tells a story that's got traders buzzing with anticipation. After weathering a brutal decline, EUR/USD has found its footing near a crucial Fair Value Gap (FVG) that's acting like a magnet for buying interest. This isn't just any ordinary support level – it's the kind of zone where smart money typically steps in to accumulate positions.

What makes this setup particularly compelling is how the Order Block (OB) below is reinforcing the bullish narrative. These institutional footprints rarely lie, and when they align with price action like this, seasoned traders know to pay attention. The combination creates a technical fortress that could launch the pair toward much higher ground.

The beauty of this setup lies in its simplicity. If these support areas keep holding firm, EUR/USD bulls have a clear roadmap toward the next major liquidity pool. It's the kind of scenario where risk-reward ratios start looking incredibly attractive for those positioned correctly.

Key EUR/USD Levels Paint Bullish Road Map

Market structure analysis reveals a fascinating battle between Sell-Side Liquidity (SSL) below and Buy-Side Liquidity (BSL) targets above. The SSL represents where stops are clustered on the downside, while BSL shows where the real prize money sits for successful bulls.

Right now, EUR/USD is dancing around these critical levels like a coiled spring. The FVG and OB zones have proven their worth as support, and if they continue holding, the path toward those juicy BSL targets becomes increasingly clear. This is exactly the type of setup that generates explosive moves when institutional money decides to play.

Smart traders are watching these levels like hawks because they understand what happens when liquidity gets swept. If EUR/USD can maintain its composure above current support, the next move could surprise even the most optimistic bulls with its magnitude and speed.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah