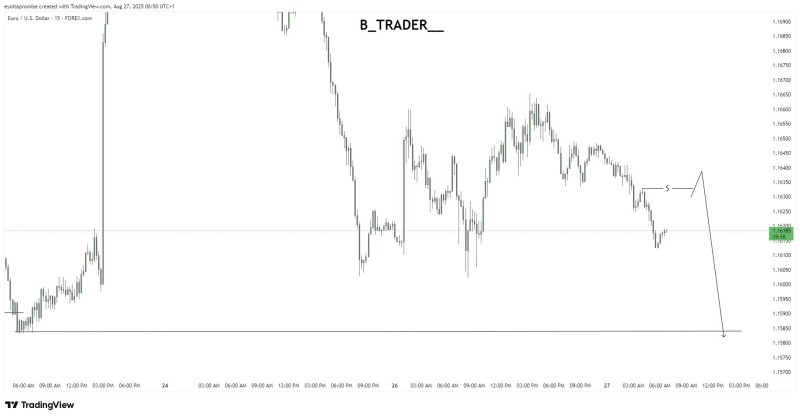

The EUR/USD pair finds itself at a critical juncture after a week of volatile trading. What looked like a promising bounce has quickly turned into consolidation, leaving traders wondering whether the recent rebound was just a brief pause or the start of something bigger. With the pair now hovering around key technical levels, the next move could determine the short-term direction for weeks to come.

EUR/USD Price Action Signals Bearish Potential

In his post, @B_trader__ addressed his audience with a striking question:

“Who else is looking for a sell opportunity on EUR/USD?”

This reflects the growing sentiment among market participants that recent rebounds are corrective, not sustainable, and that sellers are ready to regain control.

Trading around 1.1618, EUR/USD is flashing some interesting technical signals that have caught traders' attention. The recent price action tells a story of failed momentum—after briefly touching highs above 1.1670, the pair couldn't hold its ground and started forming lower highs.

This kind of rejection at resistance often spells trouble, and many traders are now eyeing a short setup targeting the 1.1580 support zone. The 1.1630-1.1640 area has emerged as immediate resistance, and any rejection here could accelerate the move lower.

EUR/USD Market Drivers to Watch

Technical setups are one thing, but fundamentals are backing up the bearish case too. European economic data hasn't been painting a pretty picture lately, while the dollar continues to flex its muscles thanks to higher Treasury yields and the Fed's cautious approach to rate cuts.

This combination of weak euro fundamentals and dollar strength creates a compelling case for further downside. If 1.1580 gives way, we could be looking at an extended decline that catches a lot of traders off guard.

Usman Salis

Usman Salis

Usman Salis

Usman Salis