The EUR/USD pair is experiencing significant downward pressure as bears assert their dominance in the current trading session. With the currency pair struggling to maintain its footing above crucial technical levels, traders are closely watching for potential breakdown scenarios that could accelerate the decline. Market dynamics suggest a shift in sentiment, with selling momentum building as key resistance areas continue to reject upward attempts.

Bears Take Control as EUR/USD Breaks Key Resistance

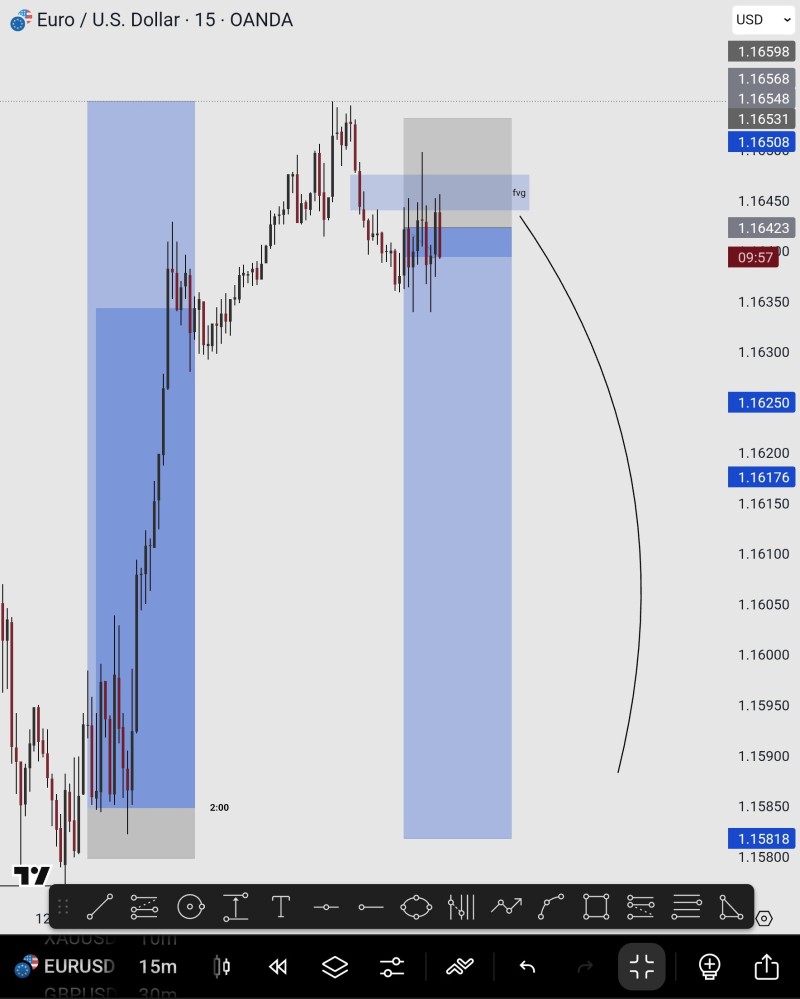

Trading at approximately 1.1642, the EUR/USD has failed to sustain its position above the critical 1.1650 threshold, signaling a potential shift in market structure. Trader @YareemaFx recently highlighted through technical analysis that order flow patterns indicate growing bearish control, with institutional selling pressure overwhelming retail buying interest.

The rejection from higher levels has created a fair value gap that's acting as a strong resistance zone, effectively capping any near-term recovery attempts and reinforcing the downward trajectory.

Critical Support Zones Could Determine EUR/USD's Next Move

The immediate downside targets for EUR/USD include the 1.1625 support level, followed by 1.1617 if selling pressure intensifies. Should these levels fail to provide adequate support, the pair could extend its decline toward the more significant 1.1581 zone, where historical buying interest has previously emerged. However, any meaningful recovery would require a decisive break back above 1.1650, which would need to be accompanied by strong volume to convince market participants that the bearish scenario has been invalidated and bullish momentum is returning to the pair.

Peter Smith

Peter Smith

Peter Smith

Peter Smith