The EUR/USD pair finds itself at a critical juncture, trading around 1.1640 as market participants weigh competing forces. With the pair caught between well-defined support and resistance levels, traders are positioning themselves for the next significant move. The coming sessions could prove pivotal in determining whether the euro can mount a sustained rally against the dollar or face another leg lower.

The EUR/USD is stuck in a narrow range around 1.1640, with traders eyeing the key 1.1655–1.1660 resistance zone for clues about future direction. This level has repeatedly capped upside moves, creating a make-or-break scenario for euro bulls.

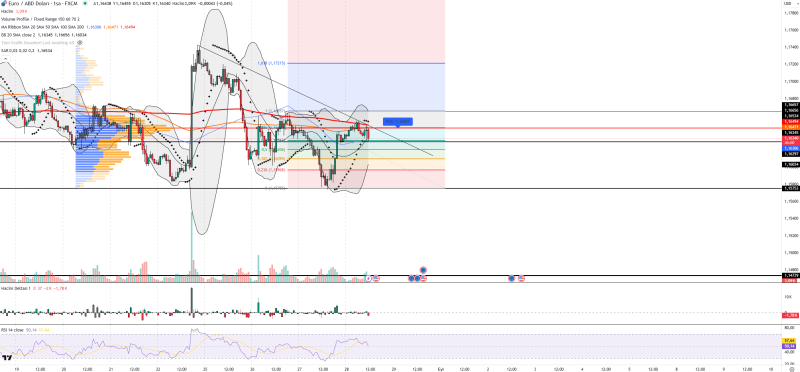

Technical Outlook for EUR/USD

Market analyst @forexsinyalmrkz identifies the 1.1655–1.1660 area as the line in the sand. A clean break higher could spark momentum toward 1.1721, while rejection risks a pullback to Fibonacci support levels around 1.1620.

The hourly chart shows a descending trendline converging with the 1.1655–1.1660 resistance band, creating a technical squeeze:

Key Levels:

- Fibonacci 0.618 at 1.1620 → solid support floor

- Fibonacci 1.0 at 1.1657 → immediate resistance hurdle

- 1.1721 → next upside target on breakout

Technical Indicators:

- RSI (14) at 50 → momentum remains neutral

- Bollinger Bands → compressed, signaling low volatility

- Volume Profile POC at 1.1645 → current equilibrium point

- Parabolic SAR → sitting above price, hinting at bearish undertone

Support:1.1620 • 1.1603 • 1.1573 Resistance: 1.1645 • 1.1657 • 1.1721

Fundamentals Supporting EUR/USD Price

Several fundamental factors are influencing the pair's direction:Fed Policy: Markets are pricing in potential rate cuts, which could weaken the dollar and support EUR/USD upside.Eurozone Politics: Ongoing French political uncertainty continues to weigh on euro sentiment, limiting bullish momentum.SNB Reserves: Switzerland's central bank shifting reserves from USD to EUR provides underlying support for the euro.

The hourly chart shows a descending trendline converging with the 1.1655–1.1660 resistance band, creating a technical squeeze:

Key Levels:

- Fibonacci 0.618 at 1.1620 → solid support floor

- Fibonacci 1.0 at 1.1657 → immediate resistance hurdle

- 1.1721 → next upside target on breakout

Technical Indicators:

- RSI (14) at 50 → momentum remains neutral

- Bollinger Bands → compressed, signaling low volatility

- Volume Profile POC at 1.1645 → current equilibrium point

- Parabolic SAR → sitting above price, hinting at bearish undertone

Support: 1.1620 • 1.1603 • 1.1573 Resistance: 1.1645 • 1.1657 • 1.1721

Fundamentals Supporting EUR/USD Price

Several fundamental factors are influencing the pair's direction:

Fed Policy: Markets are pricing in potential rate cuts, which could weaken the dollar and support EUR/USD upside.

Eurozone Politics: Ongoing French political uncertainty continues to weigh on euro sentiment, limiting bullish momentum.

SNB Reserves: Switzerland's central bank shifting reserves from USD to EUR provides underlying support for the euro.

Peter Smith

Peter Smith

Peter Smith

Peter Smith