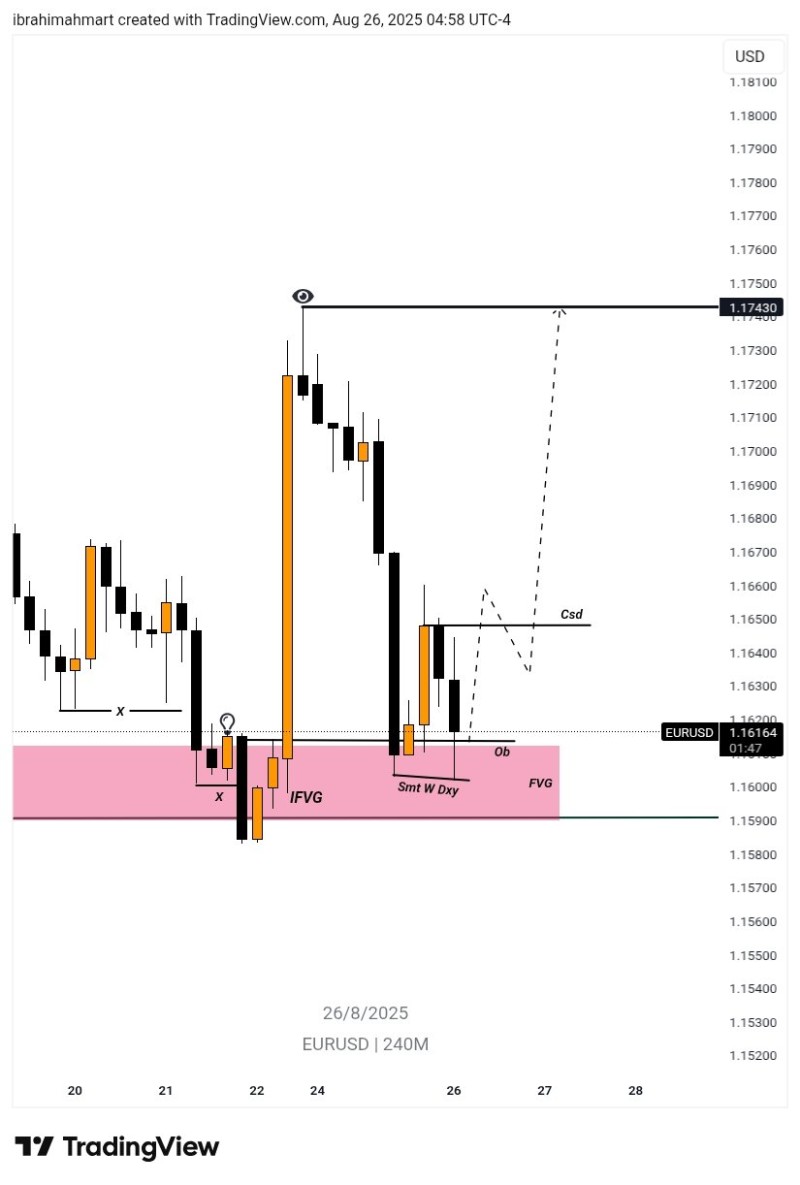

The EUR/USD pair finds itself at a pivotal moment as it trades near the psychologically important 1.1616 level. With market participants closely monitoring price action around this critical juncture, the euro-dollar exchange rate appears to be setting up for a potential directional move that could determine its short-term trajectory. The current consolidation phase has caught the attention of forex traders worldwide, as technical indicators suggest we may be approaching a significant inflection point.

Support Defense at 1.1616 Sparks Bullish Hopes

Aanalyst @Ib_Forex01 highlights that EUR/USD is currently defending a crucial support zone between 1.1600 and 1.1590, with the pair trading within a fair value gap that has attracted fresh buying interest.

This technical setup suggests that institutional demand may be stepping in to prevent further downside, creating a foundation for potential upward momentum. The price action around 1.1616 has shown resilience, with each dip being met by buyers who view these levels as attractive entry points.

Target 1.1743 Comes Into Focus for Bulls

Should the current support levels hold firm, technical analysis points toward a potential rally targeting the 1.1743 resistance zone. This upside objective represents a logical progression for bulls who have successfully defended the lower bounds of the recent trading range. However, traders remain cautious as a decisive break below 1.1600 could invalidate the bullish scenario and open the door for deeper retracement levels. The coming sessions will likely prove crucial in determining whether EUR/USD can mount a sustained recovery or faces renewed selling pressure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah