XRP investors are facing a potential storm as on-chain metrics reveal troubling patterns in token movement. When large amounts of cryptocurrency suddenly appear on exchanges, it typically signals one thing: people are getting ready to sell. The latest data shows exactly this scenario unfolding with XRP, and the numbers are significant enough to make even seasoned traders take notice.

Trader Sounds the Alarm on XRP Exchange Inflows

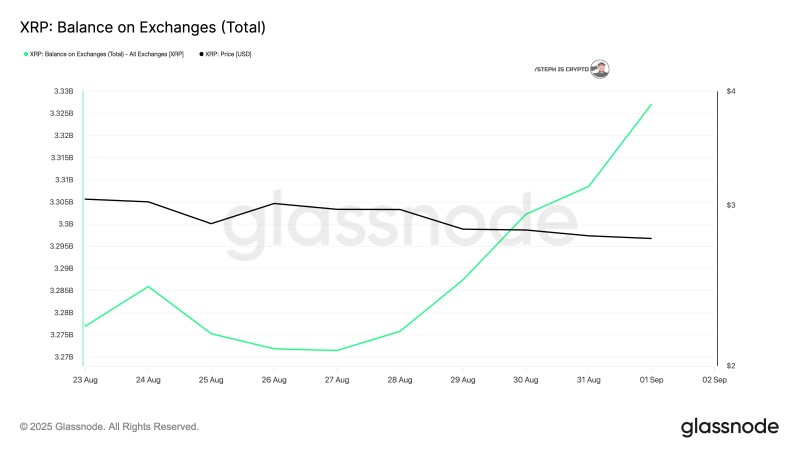

Crypto trader @Steph_iscrypto was quick to spot this red flag and shared it with his followers. The data shows a steady climb from around 3.27 billion tokens in late August to today's 3.33 billion peak.

When investors move their crypto from personal wallets to exchanges, it's usually because they're planning to sell. For analysts like Steph_iscrypto, this is a clear bearish signal that could spell trouble ahead.

What Rising XRP Supply Means for the Price

More supply hitting the market typically means one thing - downward pressure on price. It's basic economics: when there's more of something available to buy and demand stays the same, prices tend to fall.

If holders start dumping this 3.33 billion XRP, it could create a domino effect of selling that pushes the price down fast. Traders are now watching key support levels to see if they can weather this potential selling storm.

But there's another side to this story. Sometimes rising exchange balances just mean people are getting ready to trade more actively, not necessarily sell everything. Plus, the broader crypto market - especially what Bitcoin does - still has a huge influence on XRP's direction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah