XRP is having a rough week, but sometimes the best opportunities hide behind the worst-looking charts. While whales are clearly hitting the exit button, seasoned traders are spotting something interesting in the price action that could flip this narrative completely by year-end.

XRP Price Gets Hammered as Whales Head for the Exit

XRP took a beating on August 21st, sliding to $2.8841—a painful 2.27% drop that has holders questioning what's next. The token couldn't hold above that psychological $2.95 level, and the daily range between $2.9588 and $2.8725 tells the story of a market lacking conviction.

But here's where it gets interesting. Analysts are eyeing the $2.33–$2.65 zone as a potential goldmine for patient buyers. This area represents a massive fair value gap on both daily and weekly charts, and if XRP revisits these levels, it could trigger serious accumulation from smart money.

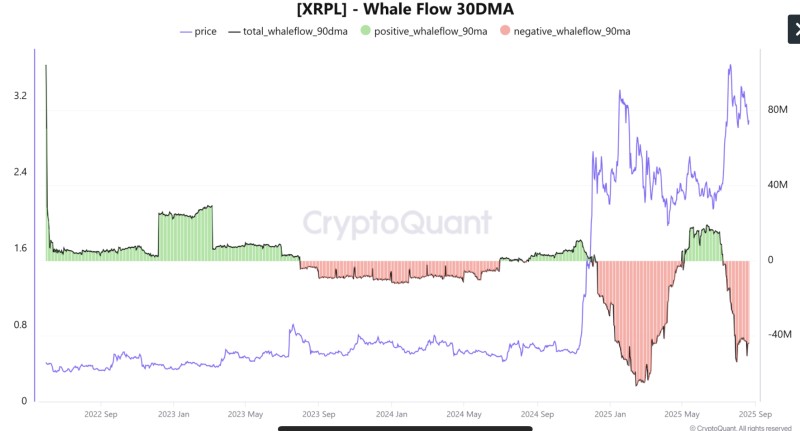

The whale data from CryptoQuant isn't helping the bulls right now. The 30-day whale flow indicator is flashing red with sustained outflows, meaning the big players are clearly reducing their positions. This kind of selling pressure usually means more downside before any meaningful bounce.

XRP's Q4 Breakout Could Deliver 85% Returns

Here's where the story gets exciting. Despite all the current negativity, technical analysts are seeing fractal patterns that historically preceded XRP's biggest rallies. Sometimes the market's memory is longer than its current mood.

The magic number everyone's watching is $3.85. If XRP can reclaim this level with conviction, we're potentially looking at a 60-85% explosion toward targets between $4.35 and $4.85. That's not just wishful thinking—it's based on measured moves from previous breakout patterns.

The macro backdrop could be the catalyst XRP needs. With the Fed potentially cutting rates and risk appetite returning to crypto markets, conditions might align perfectly for a Q4 surge. The key levels to watch are crystal clear: defend that $2.33–$2.65 support zone, break above $3.85 resistance, and let momentum do the rest.

Key Levels:

- Current: $2.8841

- Critical resistance: $3.85

- Upside targets: $4.35–$4.85

- Key support: $2.33–$2.65

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah