XRP is at a critical crossroads that could shape its price direction for weeks ahead. After enjoying a solid rally, the cryptocurrency is now facing its biggest test at a key technical level. The outcome of this battle between buyers and sellers at crucial support could determine whether XRP continues its upward momentum or faces a significant pullback that many traders are closely watching.

Famous Trader Pinpoints the $2.74 XRP Make-or-Break Level

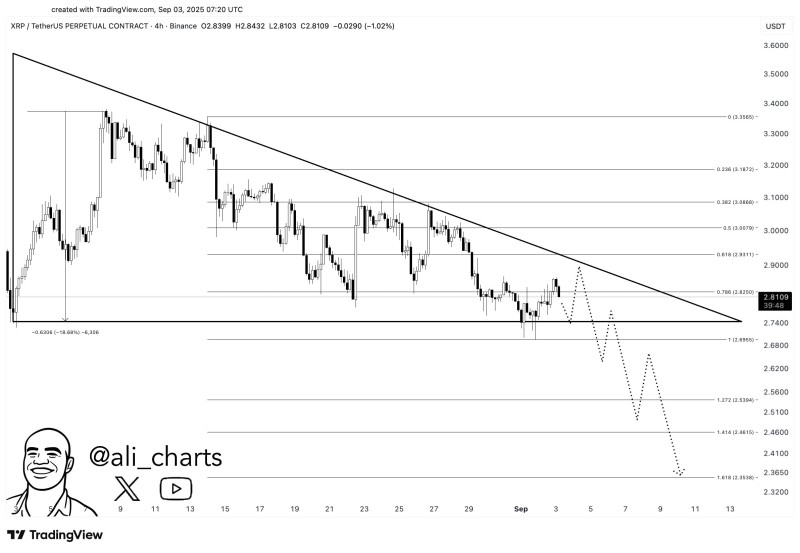

Looking at the XRP/USDT chart on TradingView using Binance data, crypto analyst @ali_charts has identified $2.74 as the critical line in the sand. This isn't just any random number - it's the 0.382 Fibonacci retracement level from XRP's recent move up. Right now, XRP is trading around $2.81, down about 1% from earlier highs.

Ali's message is straightforward: "XRP must hold $2.74 support! Lose it, and $2.35 could be next." That $2.35 target sits at the 0.618 Fibonacci level and would mean an 18.65% drop from XRP's recent peak near $3.40. The chart shows this potential downward path through various Fibonacci support zones.

The XRP Price Forecast: Bullish Hopes vs. Bearish Realities

For the bulls to stay in control, they need to defend that $2.74 level aggressively. If they can pull it off, XRP might bounce back toward $3.00 and potentially retest the $3.20-$3.40 resistance area. The fact that selling volume has been decreasing could give buyers a chance to step in and support the price.

But the bearish scenario is pretty clear-cut. If XRP closes below $2.74 on the 4-hour chart, it would break the current bullish pattern and likely trigger a cascade of sell orders. This could push the price down through other support levels at $2.62 and $2.51 before reaching that main target of $2.35. Volume will be key here - a high-volume break below $2.74 would make the drop to $2.35 much more likely.

Conclusion

The next few days are make-or-break time for XRP. The fight at $2.74 isn't just about numbers on a chart - it's the difference between a normal pullback and a serious correction. Everyone's watching to see if the bulls can hold this line or if the bears will push through toward that $2.35 target.

Peter Smith

Peter Smith

Peter Smith

Peter Smith