XRP has emerged as a standout performer in recent weeks, not just for its price stability, but for the dramatic shift in investor behavior happening beneath the surface. On-chain analytics are painting a compelling picture of renewed institutional and whale confidence, with accumulation patterns that historically precede significant price movements.

XRP Price Supported by Strong Holder Activity

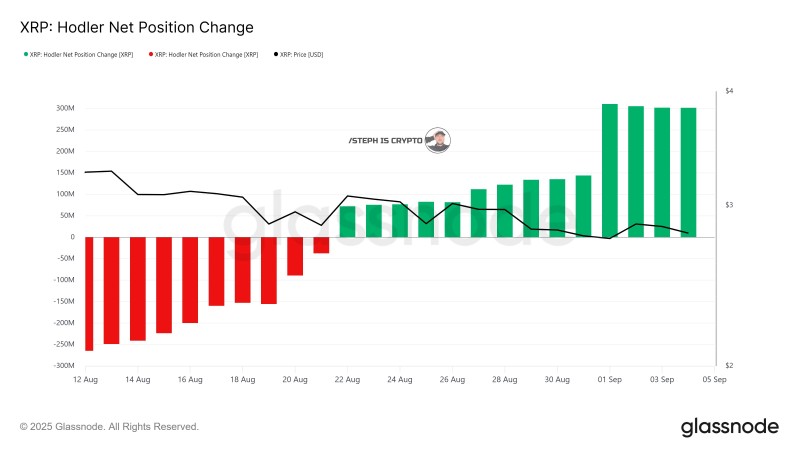

XRP is capturing renewed attention as on-chain data reveals a significant shift in investor sentiment. The Hodler Net Position Change turned decisively positive in early September, ending weeks of distribution pressure. This metric indicates that long-term holders are actively increasing their positions, providing strong foundational support for the asset.

The data shows these committed investors are stepping in with genuine conviction, creating a bullish undercurrent that could support price appreciation in the coming weeks.

Trader Highlights Bullish Accumulation Trend

Prominent crypto analyst @Steph_iscrypto drew attention to this trend, highlighting net inflows exceeding 300 million XRP from long-term holders. This represents a dramatic turnaround from mid-August when outflows were the dominant force.

Such aggressive accumulation by seasoned holders often serves as a precursor to significant rallies. The pattern suggests these investors see value at current levels and are positioning for potential upside, making this development particularly noteworthy for traders monitoring breakout opportunities.

XRP Price Outlook: $4 Resistance in Focus

Despite XRP maintaining relative stability within the $3–$4 range, the underlying accumulation activity tells a more optimistic story. With whales and institutional players actively building positions, XRP appears well-positioned to test the crucial $4 psychological resistance level.

If this accumulation trend continues, it could provide the momentum needed for a sustained breakout above $4, especially as broader cryptocurrency market sentiment shows signs of improvement.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah