Stellar (XLM) is stuck in neutral right now, barely moving 0.3% in the last 24 hours. Over the week, it's down 2.8%, though bulls can still point to solid 35% gains over three months as proof there's life left in this trade.

The problem? Stellar's DeFi scene is basically flatlining, and that's putting a serious damper on any price recovery hopes.

XLM Price Struggles as DeFi Activity Stays Ice Cold

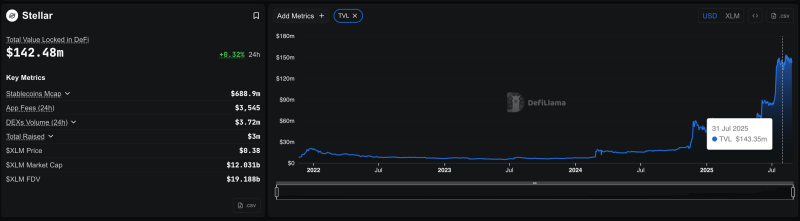

Here's the brutal reality: Stellar's total value locked (TVL) in DeFi has gone nowhere fast. Back on July 31, it sat at $143.35 million. By August 27? It had actually dropped to $142.48 million. Meanwhile, competitors like Solana and BSC have been seeing decent DeFi growth spurts during the exact same period.

This DeFi weakness is clearly weighing on XLM price action. But there's a twist – retail traders are still trying to catch the falling knife. Net outflows have been running for five straight days, jumping from $3.38 million on August 23 to $9.85 million on August 27. That's nearly a 200% spike, showing people are still betting on a bounce.

The one bright spot? Stellar's Real World Asset (RWA) segment is actually crushing it, up over 13% this month to $510.79 million. If Stellar can tap into that momentum, it might offset the DeFi drag on XLM price.

Technical Signals Show XLM Price Fighting for Its Life

The charts tell an interesting story. XLM's daily RSI has been testing the same floor at 42.70 without cracking lower, which suggests sellers aren't as strong as they look. Between August 19-21, the RSI even formed a higher low while price made a lower low – that divergence triggered a sharp green candle that caught shorts off guard.

For a real reversal, we'd need to see the RSI make another higher low while price drifts sideways. That would signal sellers are running out of gas and give buyers room to push XLM price higher.

Key XLM Price Levels That Actually Matter

Right now, Stellar is trapped in a descending triangle – and that's usually bad news for bulls. The pattern points to more downside unless key levels break.

The make-or-break level is $0.37 support. If that cracks, we're looking at deeper losses as stop-losses get triggered. On the flip side, XLM needs to clear $0.39 resistance first, then tackle the bigger challenge at $0.42-0.43. Breaking that zone would flip the script and potentially kill the bearish pattern.

Until then, XLM price is stuck in limbo, waiting for either buyers or sellers to make their move.

Peter Smith

Peter Smith

Peter Smith

Peter Smith