Seven major asset managers just filed updated paperwork with the SEC for spot Solana ETFs, potentially boosting SOL's price. Big names like Bitwise, Fidelity, and VanEck are pushing forward, with approval possibly coming by late August.

Big Players Are Going All-In on SOL ETFs

The Solana ETF race is heating up. As of August 1st, seven heavyweight firms - Bitwise, Canary Capital, Fidelity, CoinShares, Grayscale, Franklin Templeton, and VanEck - submitted updated S-1 registration forms to the SEC.a ETF

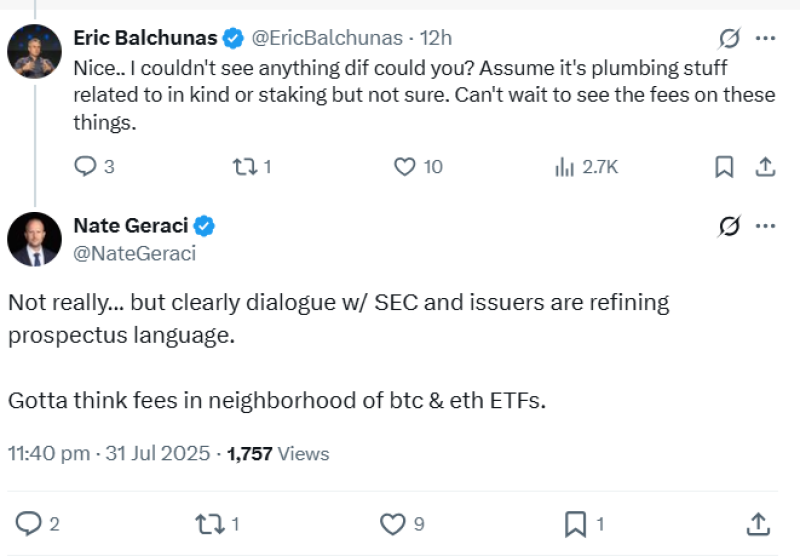

These S-1 documents are official proposals that lay out how the funds would work, fees, and SOL token handling. When companies amend these filings, it usually means they're responding to SEC feedback. Market analyst Nate Geraci noted that while recent amendments weren't major, they show companies and regulators are working together to finalize details.

Solana (SOL) ETF Approval Timeline Looks Promising

Here's how it works: The SEC reviews S-1 forms, asks questions, and companies respond until the SEC is satisfied. There's also a 19b-4 filing needed to list ETFs on exchanges - some firms have already filed theirs.

Last month, sources said the SEC asked companies to address in-kind redemptions and staking rewards. Then on July 30th came the game-changer - the SEC approved in-kind creation and redemption for all Bitcoin and Ethereum ETFs. This suggests Solana ETFs are likely next.

The SEC usually responds to amended filings within 2-4 weeks. Given the procedural nature of recent updates and ongoing talks, final decisions could come by late August or September.

What This Means for SOL Price

Market confidence is high - Polymarket bettors are almost certain Solana ETFs will get approved by end of 2025. ETF approvals historically drive price momentum, as we saw with Bitcoin and Ethereum ETFs.

Seven major asset managers pushing simultaneously isn't coincidence. These firms only invest resources where they see real demand and profit potential. Their collective bet on Solana suggests strong long-term confidence in SOL.

With multiple applications moving through the system and the SEC's recent crypto-friendly moves, SOL holders could be in for significant gains if approval comes through in the coming months.

Peter Smith

Peter Smith

Peter Smith

Peter Smith