Major investors are selling while retail traders buy the dip, creating a battle that could determine SOL's next move.

Solana (SOL) has crashed 12.38% this week, falling from $206 to $159. Currently trading around $162 after a 3.95% daily drop, SOL is stuck in a downward trend with bearish technical signals flashing.

The interesting part? Big money is selling while everyday traders are buying the dip.

Whale Dumps $17.7M Worth of SOL

A massive whale just moved 108,016 SOL tokens worth $17.74 million to OKX and Binance, according to Lookonchain. When whales deposit this much on exchanges, they're usually about to sell.

What's telling is the timing. CryptoQuant data shows these big players had been quiet during SOL's recent recovery. But as soon as prices dropped, they came back to dump their bags instead of buying cheap.

This kind of institutional selling usually signals they don't expect a quick recovery.

SOL Futures Market Turns Bearish

The derivatives market is equally pessimistic. SOL's Long/Short Ratio sits at 0.9231, meaning more traders are betting on further drops. Open Interest fell 7.28% to $9.30 billion, while volume jumped 4.62% to $26.72 billion.

Binance data shows a 2.57 position ratio favoring shorts, confirming the bearish sentiment.

Retail Steps In as SOL Price Falls

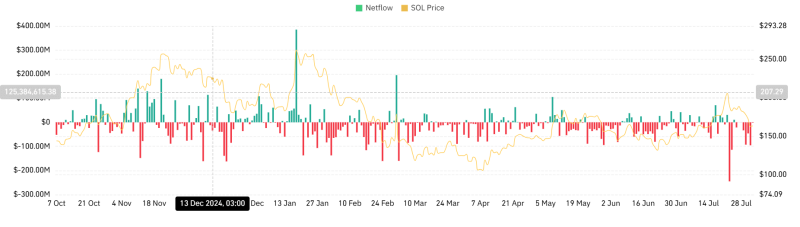

While whales sell, retail investors are buying. CoinGlass shows SOL has had negative netflows for seven straight days, with the current netflow at -$1.86 million. This means more coins are leaving exchanges than entering - a sign of accumulation.

The question is whether retail buying can absorb continued whale selling pressure.

What's Next for SOL Price?

Technical indicators look rough. RSI dropped to 41 and Stochastic RSI hit 0.07, both confirming seller dominance.

If bearish momentum continues, SOL could test $154 support next. However, if retail investors keep buying and hold strong, SOL might push back toward $183. Right now, the technicals and whale behavior favor more downside.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah