After nearly five years of legal warfare, the crypto world finally has closure on one of its most watched battles. The SEC versus Ripple case—a saga that has dominated headlines, influenced regulations, and kept XRP holders on edge—has reached its conclusion. What started as an aggressive enforcement action in late 2020 has ended with Ripple standing victorious and the SEC backing down from its appeal.

This isn't just another legal settlement. It's a landmark moment that could reshape how regulators approach the entire crypto industry, while potentially unleashing years of pent-up demand for XRP.

SEC Withdraws Appeal, Ripple Declared Victorious

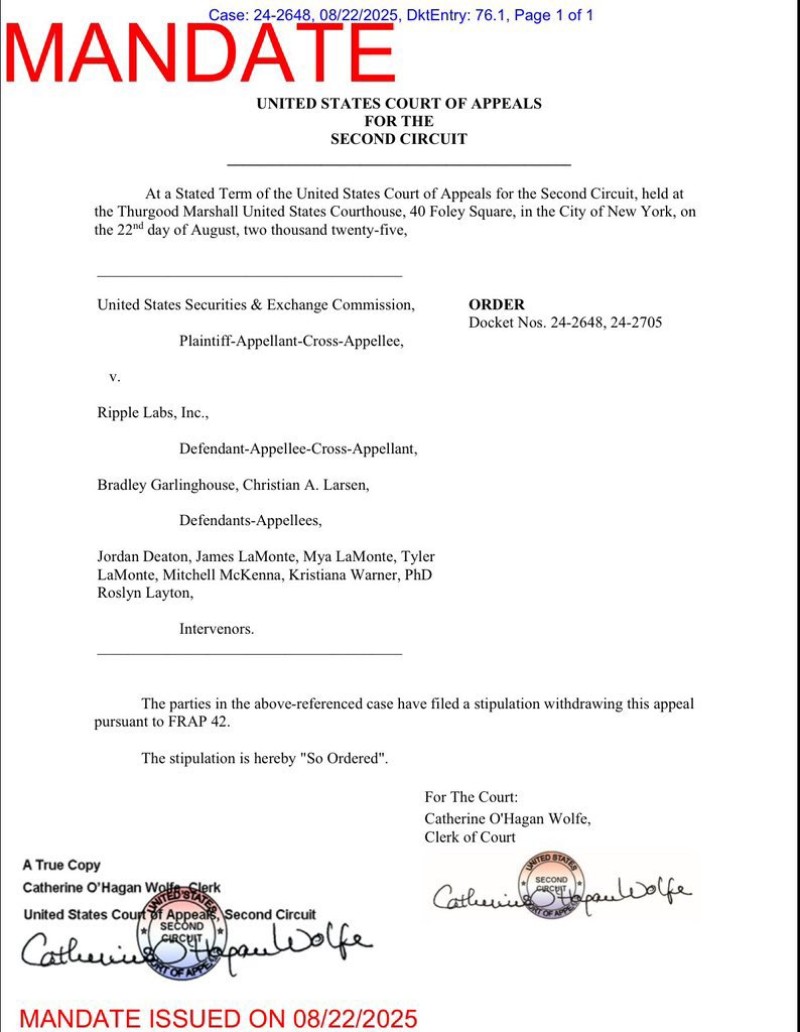

The final nail in the coffin came yesterday when the US Court of Appeals for the Second Circuit made it official. According to trader @amonbuy, the court issued its mandate confirming the SEC had thrown in the towel on its appeal against Ripple Labs.

The document, signed by Clerk of Court Catherine O'Hagan Wolfe on August 22, was crystal clear: the appeal is withdrawn under FRAP 42 and "So Ordered." No more legal maneuvering, no more delays—the case is done.

For Ripple CEO Brad Garlinghouse and co-founder Chris Larsen, who've spent years fighting these charges, vindication tastes sweet. But the real winners might be the millions of XRP holders who've weathered this storm.

XRP Price Reaction to the SEC Withdrawal

The crypto community didn't waste time celebrating. Within hours of the news breaking, bullish sentiment flooded social media and trading channels. The legal cloud that's hung over XRP since 2020 has finally lifted, and traders are positioning for what could be a significant rally.

Here's what has everyone excited: major US exchanges that delisted XRP during the lawsuit can now consider bringing it back. That means more liquidity, more accessibility, and potentially more institutional money flowing in.

Early price targets are already floating around. Some analysts are eyeing $0.80 as the first major milestone, with $1.20 as the next stop if momentum builds. The more optimistic voices in the community are talking about much higher levels, especially if the broader crypto market cooperates.

What This Means for Ripple and the Crypto Market

This victory extends far beyond XRP's price chart. Ripple's win could signal a shift in how US regulators approach the crypto space. Instead of regulation through enforcement—the SEC's preferred method under previous leadership—there's growing pressure for Congress to step up with clear, workable rules.

For Ripple itself, the legal victory removes a massive distraction. The company can now focus entirely on expanding its cross-border payment solutions without looking over its shoulder. International partnerships that might have been on hold could accelerate, and new business opportunities in the US market are back on the table.

XRP holders, meanwhile, get something they haven't had in years: regulatory certainty. That clarity could unlock institutional adoption that's been waiting on the sidelines, potentially driving sustained demand for the token.

The crypto industry as a whole gets a precedent that could influence future enforcement cases. Ripple's successful defense might embolden other projects facing regulatory uncertainty, while giving the broader market confidence that aggressive enforcement isn't the only path forward.

After years of uncertainty, XRP's story is finally moving from the courtroom to the marketplace.

Usman Salis

Usman Salis

Usman Salis

Usman Salis