Something weird is happening with PEPE right now. While Bitcoin's dropping to $117,000 and dragging everything down, PEPE whales are getting more active. They've moved over 7.7 trillion PEPE tokens in one day – about $86.9 million worth.

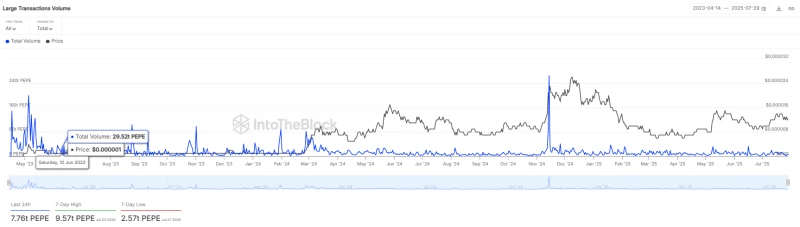

According to IntoTheBlock data, large PEPE transactions jumped 45% in 24 hours. These are moves of $100,000 or more, meaning whales and institutions are behind them. While everyone else is nervous, the big money is making massive moves.

This comes right after someone transferred 531.5 billion PEPE tokens (worth $5.06 million) to Binance when the token was trading around $0.00000929. Now PEPE is at $0.00001121, down 5.7%, but whales don't seem to care.

PEPE Whales Go Against the Trend

This whale behavior goes against what you'd expect during a market dip. Most investors step back and wait it out, but these guys are doubling down instead.

Trading volume dropped 18.2% to $775.5 million, showing regular market activity is slowing. But while everyone else takes a break, whales are ramping up. It's like they're playing by different rules.

This disconnect between retail traders (pulling back) and whales (getting more active) often leads to interesting market moves. The question is whether they're buying the dip or getting ready to dump.

PEPE Price Faces Broader Market Pressure

PEPE's struggles aren't happening alone – the whole crypto market is having a rough time. Bitcoin's at $117,788 after dropping 0.9%, and big names like Ethereum, XRP, and Solana are all dealing with volatility.

For PEPE, this isn't even the worst recently. Last month, the token added a zero after an 18% crash from global market headwinds. It dropped as low as $0.0000092, with analysts eyeing $0.00000758 as the next support level.

The current situation feels like the June market selloff. Analysts hope that once sentiment improves, tokens can bounce back. But when whales move 7.76 trillion tokens during chaos, it makes you wonder what they know that we don't. Maybe they're buying the dip, or repositioning for what's next. Either way, when smart money moves this much volume, something big usually follows.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah