- 60X With BitMEX, Dogecoin Frenzy, And The Crypto Futures Market Boom

- Cascading Liquidations

- Countries Most Prone to Crypto Volatility

- Crypto Trading Surges Globally

- Markets Affected by Crypto Volatility Amid Surging Interest

- Liquidation Prices, High Leverage, and Risk Management in Crypto Futures

- What’s Coming For Leveraged Trading in the Future: AI-Driven Trading, DeFi

- Summing It Up

In the galvanizing world of cryptocurrency, where fortunes are made or lost in market swings, futures trading is a high-stakes arena for traders who want to amplify gains.

At the heart of this adrenaline-fueled ecosystem are average margin liquidation thresholds. Here, we’ll dive into the mechanics of liquidation prices and high leverage with real-world examples of how up to 60X leveraged trades are used to make traders massive gains, but also signal deep losses, when practical strategies aren’t in use. This isn’t a cautionary tale, but a proof of how margin liquidation thresholds are shaping crypto futures trading.

We can learn from crypto market rug-pulls in the recent past, but we'll also look at market trends that are fueling more trading volume and volatility in crypto than ever before.

It’s like stepping into the gritty underworld portrayed in the movie, Fight Club. Bare-nuckle punches are the intensity of trades using cranked-up leverage. Small market turns create heart-pounding wins or bone-crushing losses. The average margin liquidation thresholds are an invisible referee, ready to call the match if your margin takes too many hits. But here are other tools to prevent that left hook from coming at you. The first rule of leveraged trading is “know your limits” before you end up in a pile of blood and bones on the trading (or Fight Club) floor, but there's more to it.

60X With BitMEX, Dogecoin Frenzy, And The Crypto Futures Market Boom

The 2020 Bitcoin crash and the 2021 Dogecoin frenzy are perfect examples of when the market can knock you out or bring you crazy gains. Doge, the meme coin born as a joke and fueled by posts from Elon Musk and Redditors, went through a staggering 18,000% gain, going from $.004 to $0.74.

Leveraged future contracts on platforms like Binance, Bybit, and BitMEX where users had futures contracts at 60X or even 100X, but the price crashed by 93% from its 2021 peak, and over-leveraged traders faced forced liquidations, losing billions. Traders couldn’t meet margins to cover losses, and those in over-leveraged futures were forced out of the market.

Traders posting, “My 100X DOGE long got wrecked in seconds,” was common. If traders overbought RSI indicators, they were wrecked.

This is just one example of the need for strategic trading using leveraged accounts. Without a clear strategy, you’re getting TKO’d. 60X gains are seductive but dangerous. DOGE’s rise and fall is not the only cautionary tale.

Cascading Liquidations

The Ethereum Shanghai Upgrade’s Fight Club Riot

In March 2023, the Ethereum Shanghai upgrade—also known as Shapella—enabled staked ETH withdrawals, a long-awaited milestone for Ethereum’s Proof-of-Stake network. This event was widely covered by crypto media, including articles by CoinDesk and Bloomberg.

Coverage and social media posts sparked crazy market speculation that drove ETH futures trades into a fevered pitch on Binance, ByBit, and Kraken. The volatility was insane. ETH prices swung between $1,800 and $2,100 in just days.

This volatility triggered cascading liquidations, akin to a Fight Club brawl erupting into chaos, where one trader’s knockout sparked a chain reaction, bringing other traders into the frenzy. The price drops triggered liquidation of leveraged positions, and those, like in the case of DOGE, who were leveraged 60X or more, along with Crypto Whales predicting $3000 ETH prices, meant just a 10% dip in price caused unbelievable selling pressure. If you were in an over-leveraged position, consider yourself wiped out. It was a vicious cycle that left few on the fighting mat.

Coinglass reported $500 million in ETH futures liquidations on April 12, 2023, with Binance alone seeing $200 million in long positions liquidated.

May 2021 Bitcoin Crash

Another prominent example is the May 2021 Bitcoin crash, driven by regulatory concerns in China and Elon Musk’s environmental critiques. Bitcoin plummeted from $60,000 to $30,000, triggering $1.8 billion in liquidations across exchanges like Binance. High leverage (up to 100x) and a 5.7 long vs. short ratio fueled the cascade, as forced sales drove prices lower, liquidating more positions.

Terra USDT Collapse

Similarly, the Terra/UST collapse in May 2022 caused a market-wide liquidation cascade. The algorithmic stablecoin’s failure erased $40 billion in value, sparking $3.7 billion in liquidations. Leveraged positions in LUNA and other alt coins were wiped out, with exchanges like BitMEX reporting rapid sell-offs.

Countries Most Prone to Crypto Volatility

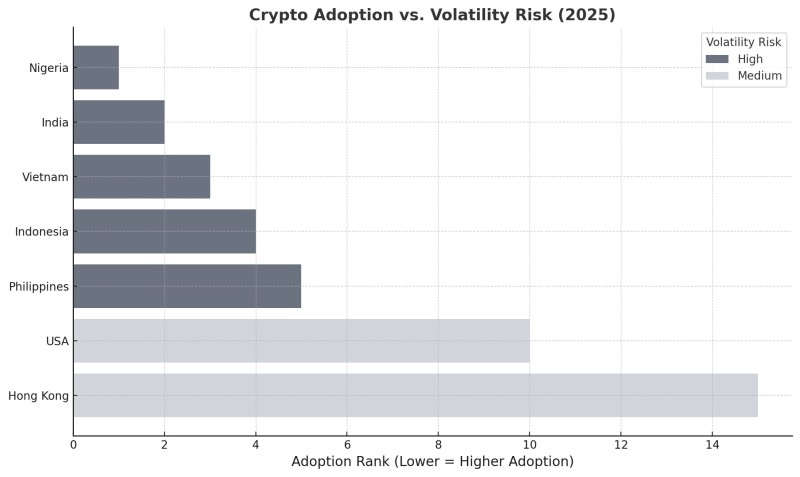

Countries with markets most prone to cryptocurrency volatility in 2025 are typically those with high crypto adoption, unstable fiat currencies, and limited regulatory frameworks.

Developing economies in Central and Southern Asia and Oceania (CSAO), such as India, Indonesia, Nigeria, Vietnam, and the Philippines, lead in crypto adoption due to economic instability, high inflation, and limited banking access, making them highly sensitive to crypto price swings.

For example, Nigeria’s naira volatility drives crypto use as a hedge, but a 10% Bitcoin drop can trigger panic selling, amplifying market instability. These countries see significant peer-to-peer (P2P) trading, with platforms like Binance reporting high volumes, but low liquidity in altcoins exacerbates volatility.

In contrast, developed nations like the United States and Hong Kong, with robust crypto ecosystems and regulatory clarity, experience volatility but are less destabilized due to institutional participation and diversified markets.

Emerging markets’ reliance on crypto for remittances and financial inclusion heightens their exposure to liquidations, as seen in the 2022 Terra/UST collapse, which hit CSAO markets hard.

The stock markets in these countries, particularly fintech sectors, correlate with crypto, with a 1% Bitcoin rise boosting S&P 500 returns by 0.54%.

Gold markets move inversely, while emerging market currencies face outflows during crypto surges. Leveraged traders in these volatile regions face heightened liquidation risks, as seen in Nigeria during the 2023 ETH's Shanghai upgrade’s $500 million liquidations. Regulatory uncertainty and retail-driven markets further amplify risks.

Graph: Crypto Adoption vs. Volatility Risk (2025)

Note: Adoption rank based on Chainalysis 2024 data; volatility risk reflects economic instability and crypto reliance.

Crypto Trading Surges Globally

Cryptocurrency markets are surging globally, driven by increased adoption, technological advancements, evolving regulatory frameworks, and the potential for stablecoins to replace outdated financial vehicles. With new laws being passed in the United States and elsewhere, the crypto Market is now a mainstream financial asset class. There is a heightened public awareness as this previously little-known asset class becomes mainstream. What was once considered a conspiracy theory or even a pipe dream – integrating blockchain technology into the traditional financial system – is now very much a reality.

Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple’s coin (XRP), and other emerging altcoins are taking over cryptocurrency exchanges with trade volumes skyrocketing. Institutional players, including hedge funds, are allocating capital to digital assets, spurred by the introduction of crypto exchange-traded funds (ETFs) and clearer regulatory guidelines in regions like the United States, Europe, and Asia.

Retail investors, using mobile trading apps and decentralized finance (DeFi) platforms, are contributing to record-breaking trade volumes.

Then there are macroeconomic factors contributing to volume surges, such as inflation concerns and a general distrust in the achingly unstable fiat system. This has goaded investors toward cryptocurrencies as a hedge or store of value.

The abundance of advanced trading tools and infrastructure further amplifies this trend. High-frequency trading algorithms, AI-driven market analysis, and enhanced liquidity on exchanges make crypto markets more efficient and appealing.

Emerging markets, particularly in Africa, Southeast Asia, and Latin America, have seen explosive growth in peer-to-peer (P2P) trading, driven by economic instability and limited access to traditional banking. Stablecoins, like USDT and USDC, have also played a pivotal role, enabling seamless cross-border transactions and providing a stable entry point for new traders.

Impact on Leveraged Traders

For leveraged traders, the surge in crypto trading presents both an unprecedented opportunity and massive risks. Leveraged trading thrives in volatile markets like cryptocurrencies, but we’re in a market on steroids.

The heightened trading volumes and price volatility create a ripe tree with fruit to pluck for leveraged traders that can capitalize on short-term price swings. For instance, Bitcoin’s frequent 5-10% daily price movements allow traders using 10x or 20x leverage to potentially achieve substantial gains from small market shifts.

The availability of sophisticated trading platforms, offering high leverage ratios (sometimes up to 100x), has attracted risk-tolerant traders seeking outsized returns.

However, the risks for leveraged traders are magnified in this environment. The same volatility that enables large profits can lead to catastrophic losses, especially in a market that can deal an instantaneous correction or “flash crashes” in mere seconds.

There will be more instances of leveraged positions being forcibly closed due to insufficient margin, during volume surges. The 24/7 nature of crypto markets, combined with global participation, means price movements can occur unpredictably, catching over-leveraged traders off guard.

Moreover, the influx of inexperienced retail traders, drawn by the hype of rising prices, has led to increased market noise and manipulation risks, such as pump-and-dump schemes. Leveraged traders need to navigate this market while managing high borrowing costs and margin requirements.

Regulatory scrutiny also looms large, as authorities in various countries tighten rules on leveraged crypto trading to protect retail investors, potentially limiting access to high-leverage products.

It’s a double-edged sword.

Markets Affected by Crypto Volatility Amid Surging Interest

Cryptocurrency volatility, augmented by surging global interest, can greatly impact various markets. The stock market, particularly tech and fintech sectors, is highly sensitive to crypto surges, due to correlations with crypto assets like Bitcoin. The trading of Bitcoin and other large market share crypto assets can influence investor sentiment and capital flows.

For instance, a 1% rise in Bitcoin’s historical returns can boost S&P 500 returns by 0.54%, but negative crypto shocks can depress equity prices.

Gold markets usually move inversely to crypto, as investors shift between digital and traditional safe-haven assets during volatility spikes.

Emerging market currencies also face pressure, as crypto adoption in regions with unstable fiat currencies drives capital outflows, increasing volatility.

DeFi and blockchain-related equities see amplified price swings due to their direct linkage to crypto ecosystems.

The 2023 crypto market cap, doubling to $1.72 trillion, is the perfect example of the growing influence of crypto trading on other markets, and it will only continue to grow as more ETFs emerge.

Leveraged traders in these markets face heightened liquidation risks, as crypto’s 24/7 trading and rapid price swings can trigger cascading liquidations, especially in illiquid altcoin markets.

| Market | Impact of Crypto Volatility |

| Stocks (Tech/Fintech) | High correlation, sentiment-driven swings |

| Gold | Inverse correlation, safe-haven shifts |

| Emerging Market Currencies | Capital outflows, increased volatility |

| DeFi/Blockchain Equities | Direct linkage, amplified price movements |

Liquidation Prices, High Leverage, and Risk Management in Crypto Futures

In crypto futures, you don’t just fight the market—you fight yourself. Liquidation price calculators, stop-loss orders, and liquidation heatmaps are like a security team for traders. With them, you can more easily anticipate the market’s next swing.

Stop-loss orders offer a defensive stance to mitigate devastating blows. Think of the 2022 FTX collapse or the 2023 Ethereum snafu.

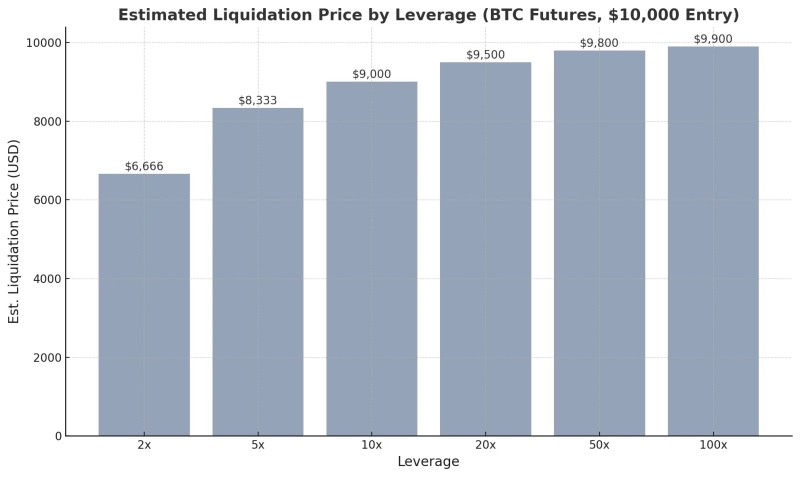

For example, Leverage.Trading’s calculator lets you adjust leverage and see how it impacts your liquidation price, so you can make an informed decision.

The calculator enables precise adjustments to leverage and reveals impact on liquidation prices. If you input position size, entry price, and leverage ratio, the calculator will show you how higher leverage tightens your liquidation threshold, usually increasing risk, while lower leverage offers more price movement buffer.

This can help you set stop-loss orders and manage risk effectively. As crypto interest surges, tools like these will be crucial for navigating volatile markets like stocks, gold, and emerging currencies.

Below is a graph illustrating how leverage affects the liquidation price for a $10,000 BTC position.

Note: Liquidation thresholds across crypto futures exchanges, estimated using Leverage.Trading’s calculator.

Setting stop-loss orders is another critical tactic, automatically closing positions at a predetermined loss level to prevent total wipeouts. During the 2022 FTX collapse, traders who used stop-losses on platforms like Kraken avoided devastating losses as prices tanked, a topic widely discussed on X.

Monitoring market sentiment via tools like liquidation heatmaps, popularized by platforms like CryptoQuant, can help you anticipate cascading liquidations during volatile periods, such as the 2023 Ethereum Shanghai upgrade.

By combining liquidation price calculators, conservative leverage, and stop-loss orders, you can navigate the booming crypto futures market with confidence. It’s a great time to leverage trade, as long as you know how to stop potential margin calls with smart thresholds and avoid forced liquidations.

What’s Coming For Leveraged Trading in the Future: AI-Driven Trading, DeFi

For leveraged traders looking to future tools, you can bet that AI-driven trading and DeFi Futures will significantly influence liquidation thresholds in trading crypto markets.

AI-driven trading systems and machine learning, along with the use of real-time data, will enhance market efficiencies, the ability to scalp, and to identify exit points in highly volatile markets. You’ll be able to make proactive position adjustments with AI that can more accurately predict trading algorithms, volume surges, and potential market reversals, all of which will increase market volatility.

Decentralized platforms with introduce smart contracts that can automate margin calls and liquidations. DeFi platforms will enforce dynamic liquidation thresholds based on real-time market conditions.

This could tighten thresholds during turbulent periods, increasing liquidation risks for highly leveraged traders but also reducing systemic trading risks by preventing over-leveraged positions from destabilizing platforms.

DeFi’s permissionless nature also allows for new margin mechanisms, like collateralized stablecoin pools, which could offer more flexible thresholds but introduce smart contract vulnerabilities.

Overall, these technologies may create a dual effect: AI will empower you to better manage risks, while DeFi’s automation enforces stricter, adaptive thresholds. Leveraged traders will need to adapt to these dynamics, balancing advanced tools with disciplined risk management to navigate liquidation risks. Instead of rolling with the punches, you’ll be able to more accurately determine when the market is about to punch you, and dodge.

Summing It Up

The crypto futures market, just like Fight Club’s brutal arena, thrives on high leverage but is shaped by unforgiving margin liquidation thresholds. Events like Dogecoin’s 2021 meteoric rise and crash, and the 2023 Ethereum Shanghai upgrade’s $500 million liquidation cascade, underscore the high stakes for leveraged traders.

As crypto trading surges globally, fueled by institutional investment, regulatory advancements, and technologies like AI and DeFi, volatility spills into stocks, gold, and emerging market currencies, amplifying risks and rewards.

Tools like liquidation calculators and stop-loss orders are essential. With them, traders can anticipate liquidation prices and manage volatile swings. Emerging technologies, such as AI-driven trading and DeFi futures, will refine strategies by predicting market shifts and automating dynamic thresholds, but they also introduce tighter liquidation risks and smart contract vulnerabilities.

For leveraged traders, the crypto boom offers unprecedented opportunity, but demands disciplined risk management. Without it, traders risk being “TKO’d” by rapid price drops or cascading liquidations.

By leveraging tools and maintaining strategic restraint, traders can navigate this chaotic market, dodging devastating blows while capitalizing on volatility. The future of crypto trading hinges on balancing innovation with caution, ensuring you can thrive in this high-octane, Fight Club-style financial frontier.

Peter Smith

Peter Smith

Peter Smith

Peter Smith