The cryptocurrency market continues to evolve, with certain altcoins emerging as potential institutional favorites. HYPE has recently caught the attention of traders and analysts who believe it could join the ranks of established digital assets like Ethereum and XRP. Currently trading above $55, this altcoin is demonstrating strong technical patterns that suggest significant upside potential.

Strong Technical Structure Emerges

According to trader BRUH, HYPE has the potential to establish itself as an institutional-grade altcoin alongside established names like ETH and XRP.

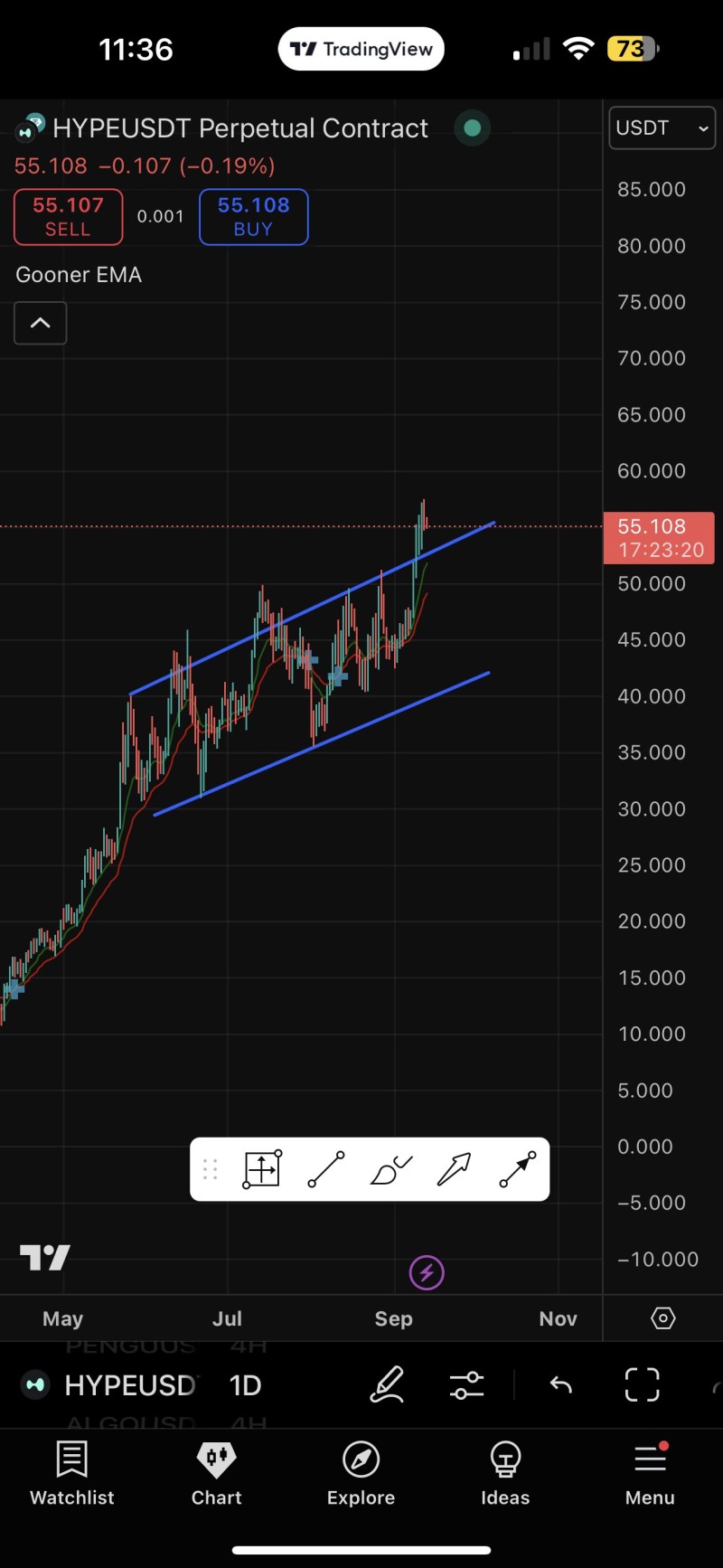

The current chart shows HYPE trading at $55.10, maintaining its position near the upper boundary of a well-defined ascending channel. This technical formation indicates sustained bullish momentum, with the price consistently forming higher lows that push the overall trend upward.

The red EMA line continues to provide crucial support during the current rally, while each bounce from the channel's lower boundary has generated additional buying interest. This pattern suggests that buyers are stepping in at key support levels, maintaining the bullish structure intact.

Institutional Recognition Potential

The growing narrative around HYPE becoming a future institutional altcoin adds significant weight to its long-term prospects. If the cryptocurrency manages to achieve similar recognition and adoption levels as Ethereum or XRP, the ambitious $400-$600 price targets become increasingly achievable. Institutional adoption typically brings enhanced liquidity, regulatory clarity, and mainstream acceptance, all of which could drive substantial price appreciation.

The technical momentum, combined with increasing trader interest, creates a compelling case for continued upward movement. However, investors should remain aware that short-term corrections could occur if the price struggles to break decisively above the current channel's upper resistance.

Market Positioning and Risk Factors

While the bullish case for HYPE appears strong, several factors could influence its trajectory. The cryptocurrency market remains highly volatile, and external factors such as regulatory developments, market sentiment, and broader economic conditions can significantly impact individual altcoin performance. Additionally, the $400-$600 target represents substantial gains from current levels, requiring sustained buying pressure and continued market confidence.

Traders and investors should monitor key technical levels, particularly the channel boundaries and EMA support, to gauge the strength of the current trend. A breakdown below critical support levels could signal a shift in momentum and potentially delay the achievement of higher price targets.

Final Thoughts

HYPE's current price action demonstrates notable resilience, with bullish momentum keeping it within its rising channel pattern. Although the $400-$600 target represents an ambitious projection, the underlying chart structure and growing institutional narrative provide reasons for optimism. Market participants will closely monitor whether HYPE can maintain its momentum and successfully transition into a recognized institutional-grade cryptocurrency.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah