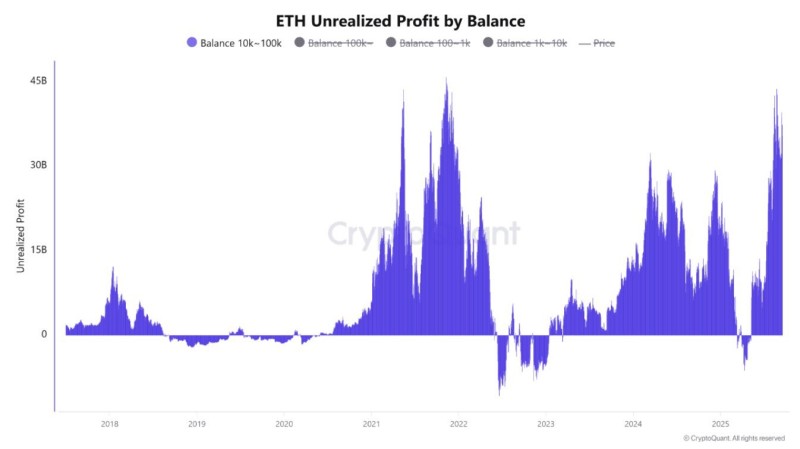

Ethereum's biggest holders just hit a milestone that should grab everyone's attention. Wallets holding between 10,000 and 100,000 ETH are sitting on unrealized profits we haven't seen since the 2021 peak when ETH was trading near $4,800. We're talking about over $30 billion in paper gains - the kind of numbers that can move markets in either direction.

What's Driving This Comeback

This recovery is remarkable considering where these same wallets were just two years ago. During the brutal 2022 bear market and early 2023, many of these whale positions were underwater or barely breaking even. As market observer Nathan Jeffay pointed out, seeing these profit levels return shows just how resilient Ethereum's biggest believers have been through multiple volatile cycles.

The resurgence didn't happen overnight. Several key factors are working together to push whale profitability back to multi-year highs:

- Staking momentum keeps growing - More ETH locked up means less circulating supply

- Layer-2 networks are thriving - Scaling solutions are driving real demand for ETH transactions

- Institutional money is circling - ETF speculation has serious players paying attention again

- Risk appetite is back - The broader macro environment is lifting all crypto boats

The Double-Edged Sword

Here's where it gets interesting. When whales are sitting on massive unrealized gains, markets reach a critical decision point. These holders could decide to cash out and enjoy their profits, which would create serious selling pressure and likely push prices down. Or they might keep holding, betting that even bigger gains are coming. History shows us that whale behavior often determines where Ethereum goes next.

The question isn't whether these profit levels matter - it's what the whales do with them. Their next move could either fuel another leg up or trigger the kind of correction that catches everyone off guard. For anyone holding ETH or thinking about it, watching these whale wallets just became a lot more important.

Usman Salis

Usman Salis

Usman Salis

Usman Salis