Something major is happening with Ethereum, and the smart money knows it. Institutional funds and whale wallets are accumulating ETH at record levels, creating the kind of supply squeeze that often precedes big moves. With staking also hitting new highs, the available ETH for trading is shrinking fast.

What the Numbers Show

Analyst Cemil points out this perfect storm of factors could be setting up Ethereum's next explosive rally.

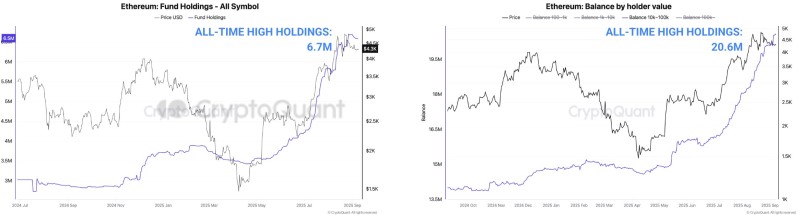

The accumulation story is crystal clear from the data. Institutional funds now control 6.7M ETH - an all-time record that's been climbing steadily since late 2024 when ETH was struggling around $1,500. Meanwhile, whale wallets have amassed 20.6M ETH, the highest concentration in Ethereum's history. These aren't small retail investors panic buying - this is patient, strategic accumulation by the players who move markets.

Key Technical Levels to Watch:

- Support Zone: $4,400 where ETH is building a solid base

- Resistance Target: $5,200 where previous rallies stalled out

- Fallback Level: $3,800 if support breaks

The charts tell a compelling story. ETH has been consolidating above $4,400, creating higher lows while demand continues building. Fund holdings accelerated as price recovered from the $1,500 lows, and whale accumulation has been relentless. This isn't random - it's coordinated positioning ahead of what could be the next leg up.

Why This Matters Now

Three forces are converging to create perfect conditions for Ethereum. First, staking has locked up 36.15M ETH, removing massive amounts from circulation. Second, on-chain activity keeps hitting new records with DeFi, NFTs, and Layer-2 solutions driving real demand. Third, institutional adoption is accelerating as traditional finance recognizes Ethereum as critical infrastructure, not just another crypto.

Usman Salis

Usman Salis

Usman Salis

Usman Salis